🎄As 2024 winds down, we thank you for reading Intercalation this year. Our mission to deliver technical journalism written by battery engineers and doesn’t happen without the energy of our subscribers and sponsors. You’re the anode to our cathode, making it all possible. ❤️

If you’ve enjoyed our work, consider subscribing at the link below. Your support pushes every article we produce. We’re immensely grateful to every one of you for staying plugged into our community.

Have feedback for Intercalation in 2025, let us know!

Finally, we’ve been very grateful to have TA Instruments as our sponsor this year.

Battery separators are critical to the performance and safety of lithium-ion batteries, allowing ion exchange while acting as a physical barrier between electrodes. Characterising separators can be difficult.

TA Instruments have an application note where you can learn how 4 thermal analysis characterize separators, offering insights to ensure battery performance and safety. Read about thermogravimetric analysis, differential scanning calorimetry, thermomechanical analysis and dynamic mechanical analysis and how they can characterise stability, decomposition and tensile strength among other things!

Want your message in front of our 10k+ weekly readers? Drop us a line here.

Each month this year, we delivered our take on the biggest battery stories in our News Roundups that moved the world: January, February, March, April, May, Summer (parts 1 & 2), September, and October.

For those seeking in-depth pricing data, our Battery Component Price Report where we report on almost all battery raw materials prices moved onto Substack paid tier: October, September, August, July, June, May, April, March, February, August 2023 - January 2024.

This is our final dispatch of the year, a roundup of 2024’s biggest news and the trends that really matter. No fluff, just the stories shaping the industry today and tomorrow. 🔋

A look back at 2024

1. Battery prices are mindblowingly low!

Chinese cell prices are down to $50-60/kWh depending on the chemistry. Some even suggest prices as low as $40/kWh. Chinese BESS system costs down to $82/kWh. These declines are pushing alternative chemistries (e.g. redox flow batteries) out, as competition intensifies and capital expenditures for battery systems continue their gradual descent.

Despite media narrative, the battery industry is still expanding though with notable shifts in its geographic and policy-driven focus, at 20% per year. Growth is increasingly influenced by regional subsidies and incentives, or the lack thereof. Markets like Germany, Sweden, and New Zealand have seen a slowdown in electric vehicle (EV) adoption following their killing of subsidies, but demand persists elsewhere, driven by aggressive industrial policies.

The global EV race is far from over, with the emphasis shifting to which manufacturers can rapidly scale high-quality production to secure market share. China continues to dominate this landscape, rocketed with its vertically integrated supply chains and economies of scale. Global EV sales are projected projected 16.7m EV sales (19.2% vehicle market share) in 2024 globally vs 13.9m in 2023.

2. Investors have officially slowed down…

Venture funding for early-stage startups has shrunk noticeably. Investors are reluctant to back super novel technologies, as Big Battery continue to improve rapidly and become more cost-effective. Global EV battery investments are projected to total $3B this year, a significant drop from the $8-10B from 2021-2023, though still above the $2.4 billion recorded in 2020.

This shift highlights a growing focus on manufacturing. Investment now targets production capacity and supply chain scaling. Deals related to electrode materials and novel chemistries, on the other hand, are seeing reduced interest. Many investors cite portfolio saturation, explaining they "already have something similar" among their holdings, further dampening enthusiasm for early-stage innovation.

Some of the biggest examples this year (also including debt funding*):

Northvolt $5B*

Rivian $5B from Volkswagen*

Verkor $1.3B*

Zenobe Energy £557M*

Ascend Elements $460M

Form $405M

Sila $375M

3. China is blowing the world away with manufacturing.

Large funding rounds in battery manufacturing shouldn’t come as a surprise—it’s an inherently challenging process that demands substantial time and capital. A report this year on ‘Mastering Ramp Up of Battery Production’ went into great detail on this.

Meanwhile, China has been investing into battery production since 2002, and now at peak performance. The country’s numerous gigafactories have created an eye-popping oversupply. Since 2022, the market has faced a staggering 400-600% oversupply.

This oversupply has directly led to the sharp decline in battery costs. We track it in BCPR, and see LFP down to $48.5/kWh in November, which tallies with reports that CATL is selling at $50/kWh. It’s not just the prices that are improving — performance metrics such as energy density are also advancing, both in publicly available data and proprietary metrics.

In contrast, the West has struggled to keep pace. US production remains limited to around 200 GWh annually, primarily from Tesla, Panasonic, and LG. Once promising projects like Our Next Energy have hit roadblocks, and many factory plans have been postponed or outright canceled. The result is a slower, more fragmented ramp-up compared to China’s well-oiled machine.

Tesla relies heavily on CATL as a supplier: using equipment from CATL and having them help with the installation. Rumors have surfaced about Northvolt—once a poster child of European battery independence—considering potential partnerships or even a lifeline from CATL. Whether this is a strategic move or a survival play remains to be seen. Either way, it remains hard (impossible for now?) to do work without China.

To keep up to date with which factories are at what stage, there’s a tracker for global manufacturing made by Jerry.

4. Consolidation is coming / has come.

Companies are finding it difficult to show an enduring value proposition with new technologies as incumbents plow through. It’s difficult to be profitable or even come close to breaking even. Many startups remain loss-making ventures with uncertain markets, resulting in bankruptcies or acquisitions. LG are implementing an aggressive IP strategy leveraging patents as a defensive tool and a way to exert influence via “mini-acquisitions” over emerging competitors.

This year has seen significant casualties. The notable losses this year have been Northvolt/Cuberg, Proterra/Volvo, Lilium, Freewire, Ionic Materials, Li-Metal. These are just the most visible examples.

We feel for the layoffs. In an effort to support displaced talent, we ran a New Homes series (1, 2, 3) to help battery professionals find opportunities elsewhere in the sector. It’s not sustainable for people to find news jobs every 2-3 years, we really hope this volatility settles.

Leadership volatility has also been pronounced in 2024, with significant turnover in the C-suite. The skills required to guide a company at TRL 3 (R&D) are vastly different from those needed at TRL 6 (manufacturing/scaling). The resulting mismatch has contributed to instability at the top of many startups.

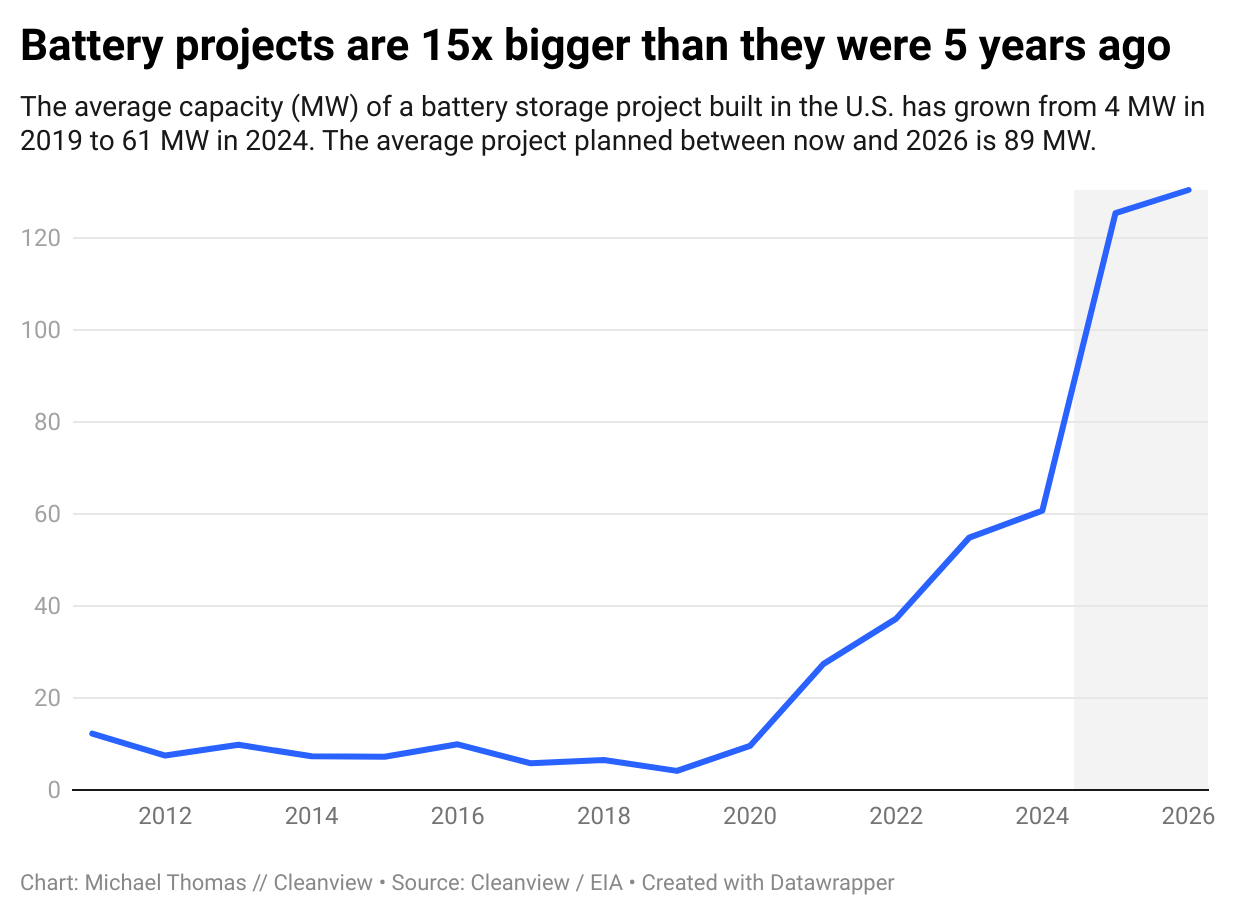

5. Grid scale energy storage is getting deployed fast

The world is deploying more energy storage, and at even bigger scales. The average project built in 2024 had 17.5x more peak capacity than the largest project built in 2019. The projects are larger and the batteries are better, with four of the world’s leading BESS manufacturers selling 5 MWh systems in a 20 foot shipping container.

China continues to push the envelope, installing its first 10 MWh sodium-ion battery storage project in May, part of a larger 100 MWh initiative.

We dedicated a focus this year to the booming grid storage landscape. Our two-part series (1, 2) covered oversizing, system performance, and failure modes and offered a deep dive into the opportunities and risks shaping the sector’s future.

6. Raw material prices for batteries remained subdued

A sharp contrast to the peaks seen in 2022, attributed to oversupply from China and cooling demand for EVs. Critics have also accused China of engaging in predatory pricing practices, further pressuring global markets. Albermarle (world’s largest lithium producer) lost more than $1 billion in Q3. Lithium is showing these ‘cyclic pains’.

Despite efforts to localize EV supply chains through subsidies, the industry remains fully reliant on foreign manufacturing. The battery chemistry of an EV affects how vulnerable it is to supply chain shocks. As always, the US government has been trying to drive more of these supply chains to the West, but building chemical production is hindered by talent shortages and heavy regulation.

Geopolitics has made graphite a hot topic, and we focussed on the world of graphite, as well as writing about an internship at Norwegian synthetic graphite manufacturer Vianode. In the UK, Oxford startup Fluorok is trying to make LiPF6 locally and without HF.

7. Is BIL a little too late?

One of the highlights for US battery manufacturing this year was the Department of Energy’s funding under the Bipartisan Infrastructure Law. However, questions remain about whether the funding is enough to make a tangible impact. So far, there’s little to show for the grants, with few companies achieving production milestones.

Funding levels are another concern. With grants of around $100 million, they barely match the estimated $100M/GWh cost of building capacity, according to Benchmark.

Compounding the challenge, the DOE funding also has strings attached and companies are returning the funding as it’s not the right time, or they’re pivoting to foreign contract manufacturing… a familiar story.

8. Being safe with batteries

Battery manufacturing remains fraught with risks, as recent incidents highlight persistent safety and quality issues. There are still a lot of “unknown unknowns”. With battery plants combining multiple complex processes under one roof, the risks of defective cells and operational shortcuts remain high.

A Missouri recycling plant had a massive fire, as did a BESS unit in San Diego. CATL had a fire in Ningde, and there was a very tragic incident in Aricell in Korea. Northvolt also faced the loss of three employees. UL tracks the number of incidents per year and there’s now a storage wiki on failure incidents. We did an analysis of BESS fires recently.

8. What’s developing on novel technologies?

Sodium ion is here. Notably, CATL's sodium-ion cells are announced to power Chery electric vehicles. The announcement and commercialization journey felt surprisingly quick! US based Peak Energy secured $55 million in Series A funding to advance sodium-ion battery production, with plans for mass production by 2027.

Recycling is not yet profitable. There’s just still not that much stuff to recycle. Companies are reportedly competing to outbid each other hard to try and scramble for production scrap to show their investors there is indeed supply. It might just not be there yet… We covered three start ups in the US, Redwood Materials, Li-Cycle and Ascend Elements, looking at their main strategies. This month we chatted to WaterCycle in the UK about how they are working on extracting minerals from wastewater.

All solid state batteries still seems a few years away… the technology remains in developmental stages. More announcements and promises, with a breakdown of Samsung’s here.

Deep sea mining is brewing. The debate continues and there’s no clear answers on this one. The US is considering legislation to permit the practice, and India and other countries are supportive of it, but many countries support a moratorium, and even Norway has delayed any plans. There is a strong global divide.

9. Pivot!

Freyr, the Norwegian battery manufacturer, appears to be turning into a solar company with a recent acquisition of Trina Solar. This reminds us of SolarEdge, which transitioned from a pure solar play to solar-plus-storage by acquiring Kokam in 2018. Last month, SolarEdge has abandoned its storage ambitions. Freyr might consider this a cautionary tale.

Meanwhile, EnergyVault went from bricks to batteries. They were sort of mocked back when they started as a company that “moved concrete blocks”. While the "brick stuff" remains part of its portfolio, the company is now investing heavily in traditional BESS using lithium-ion cells. It’s public that they’re buying from Kore but market analysts suggest Chinese suppliers may be in the mix too.

SES.ai has pivoted away from battery manufacturing altogether. The company is now all in on AI and materials informatics. On the flip side, companies like Wildcat, which initially specialized in AI and materials informatics, are moving in the opposite direction by venturing into LFP production.

10. The US is in for a wild 2025

The US is accelerating efforts to cut reliance on China for critical minerals and EV supply chains. The Biden administration is giving $15 billion to legacy automakers to retrofit their existing factories for EV production. The US Pentagon is to stop buying Chinese batteries, with a ban on procurement. This goal is to pressure domestic suppliers to scale quickly, though it may initially drive up costs for battery components.

Tariffs are also looking like they will be on the rise in 2025, but so far they MAY be ‘more bark than bite’. We wrote about this earlier this year. Trump’s presidency in 2025 could bring blanket tariffs which could have a counter effect, creating greater rockiness for businesses reliant on Chinese imports, and could exacerbate inflationary pressures and disrupt supply chains further.

The other concern is the future of the EV tax credit in the US. A rollback of these subsidies could dampen EV adoption, slowing the domestic market. There is a delicate balancing act for fostering independence from China while managing a domestic transition to greener technologies.

Congrats on making it to the end! 🎉

This holiday, we’re giving away a copy of Kanban EV, a fun strategy board game where you oversee EV production. Click here to enter!

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here