Battery production is genuinely difficult

The Northvolt Saga: A timeline of events and what insiders have to say about it.

Northvolt has been making headlines almost daily as it continues to grow and reshape the battery industry. Here's a look at some key milestones from recent years, as well as a recap of its latest developments.

“Battery production is genuinely difficult.”

2016: A star is born

Northvolt was founded by ex-Tesla folks Peter Carlsson and Paolo Cerruti to build Europe's largest lithium-ion battery factory. They announced plans to build a gigafactory in 2017, and secured environmental permits and broke ground in Skellefteå in 2018, called Northvolt Ett.

2019: Strategics

EV OEMs are keen to invest upstream. VW Group announced it was investing €900m into Northvolt. A few others join in too, including BMW Group, AMF, Folksam Group and IMAS Foundation. Northvolt and Volkswagen also announced a joint venture to build a second gigafactory in Salzgitter, Germany.

Over the next few years, Northvolt continued to raise several rounds of equity and debt financing to fuel the growth, bringing the startup’s valuation to $12b.

The company was characterised by an open attitude to trying new things and making mistakes, which made for a fast paced workplace.

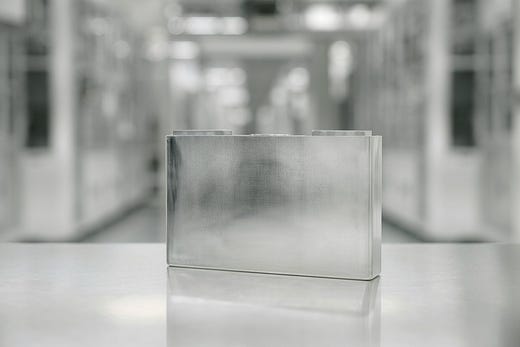

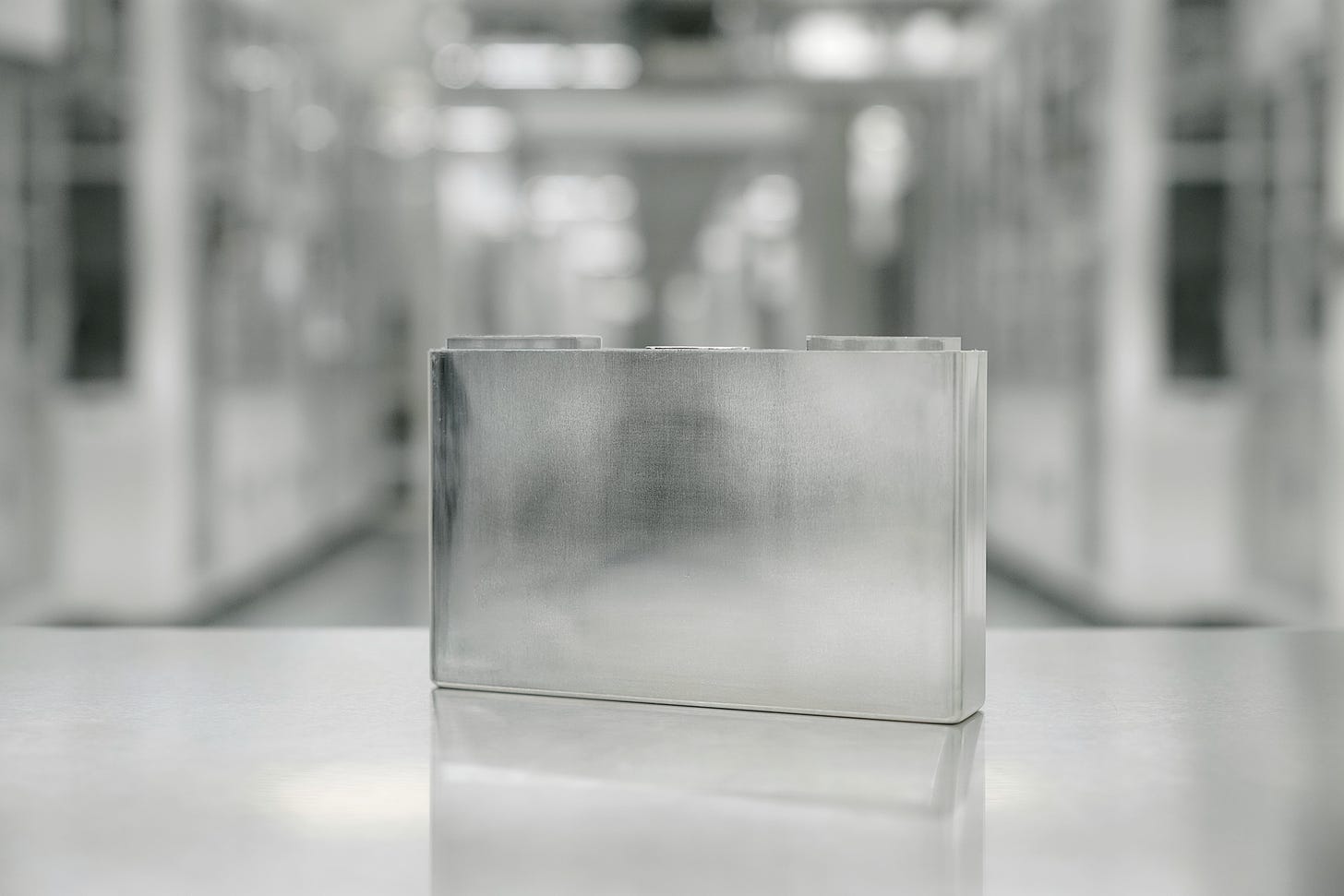

December 28, 2021: A battery is born

In 2021, Northvolt acquired Cuberg, a Li-metal battery startup in California, to accelerate next generation anode development.

Later in 2021, 3 years after breaking ground, Northvolt assembled its cell #1.

2022: Inking deals

Northvolt signed multiple supply agreements with major automotive manufacturers, securing billions in contracts.

They also announce plans to build an R&D facility in Västerås, Sweden, and third gigafactory in Borlänge, Sweden.

2023: Innovation continues

Northvolt develop a sodium ion battery with Swedish partner Altris, validated at 160 Wh/kg with a Prussian Blue cathode. Another partnership with Scania claimed the lithium ion prismatic cells could power heavy duty trucks for 1.5 million kms.

2024: The walls start to crumble

Steve Levine reports Northvolt operating at 80 MWh capacity, 1/200th of planned capacity due to overwhelming variability in cell quality and high scrap rate. This tracks… BMW canceled its $2B order due to quality issues.

Followed by safety concerns (covered by Matt Lacey in his piece “Northvolt's attitude to safety concerns me”), and even fatalities.

Ammonia levels up to 155 ppm were measured, and the maximum exposure limit set by the Swedish Work Environment Authority is 50 ppm

The company reportedly encouraged workers to continue working in affected environments with personal protective equipment (PPE) and an internally-determined exposure limit of 500 ppm, on the basis that the PPE could handle this level

Northvolt withdrew from California, shutting down Cuberg with no clear direction for continuing its lithium-metal anode development. On the other side of the battery, the cathode team has also been disbanded, leaving its future direction increasingly uncertain.

This summer, Northvolt hit the brakes, and had a reduction in force with 25% laid off at Ett… 1,600 employees “to ensure that its resources are focused on accelerating production in large-scale cell manufacturing at Northvolt Ett.” Another 400 were laid off this week. There were very real questions about whether Northvolt would be able to pay their corporate taxes.

Volvo has moved to take full ownership of joint venture NOVO, based in Gothenburg.

Northvolt employee goes on Reddit AMA

Battery production is genuinely difficult. This might sound like an excuse, but I believe that, above all, the management, as well as people on the ground, haven’t fully understood this. The podcast Kapitalet interviewed someone from the battery industry, and what strikes me when I listen to that episode is how, without knowing much about Northvolt specifically, he accurately pinpoints almost all the major problems and challenges we have or have had. Imagine building an Audi, and if you screw the dashboard on just a little too loosely, you have to scrap the whole car, but you often don’t notice until it rolls off the end of the production line. Even for an extremely skilled industrial company, this type of production would be genuinely difficult (and we are not an extremely skilled industrial company).

It was in Swedish but we’ve picked out the most eye-opening bits of their responses, translated with the help of ChatGPT.

Introduction: I’ve been at Northvolt for a couple of years in an engineering role where I’ve primarily worked with commissioning and troubleshooting of the production lines. I’ve had a lot of contact with production on the factory floor and have worked quite a bit with our subcontractors, including quite extensively with the now much-talked-about Wuxi Lead.

Tesla-like timelines at every step: The CEO and many of the early key players are ex-Tesla, and they seem to have brought with them the worst parts of Tesla’s corporate culture. Completely unreasonable timelines have been a recurring issue since around day one, from what I’ve understood. I’m not joking when I say I’ve actually heard the phrase, “management has decided that it does not accept further delays” being said. Setting tight deadlines to push people isn’t unusual in itself, but with us, it’s been done to the point where no one except the middle managers who created the PowerPoint timeline believes in it. This has also led to many instances where things had to be fixed after the fact because half-finished tasks were signed off, and it’s obviously much more complicated, tedious, and expensive to assemble your car while it’s driving than in the garage.

Completely unrealistic ambitions. We’ve tried to solve everything everywhere all at once, while also trying to “be better than” traditional industry in many ways. Besides the actual production of battery cells, we also attempted to make our own production of some key ingredients (now paused with Upstream) as well as recycling (Revolt), all at the same time. On top of that, we’ve come up with a bunch of “smart” new solutions for everything from IT to operations to how we label cables inside machines, which have all led to increased costs, delays, and problems when we’ve tried to force subcontractors to work in ways they’re not used to… If I had to pick one thing, it’s that I don’t understand how management didn’t scale down the ambitions and focus more on the existing production lines in Skellefteå early in 2023. At that point, it was blatantly obvious that we were having a very hard time scaling up production, and the "macroeconomic situation" had already changed. To push forward with expansions in every direction and lose focus on the existing lines in Skellefteå was simply irresponsible. Had they adjusted course at that point, focused on the core, and lowered ambitions, it would have been far less dramatic than what it has turned into now.

Scaling: From what I understand, the approximately 60,000 battery cells being produced per week now (varies a bit from week to week) is roughly in that range, yes. The biggest contributing factor to the current financial situation, I would say, is that they went ahead with expensive, massive expansion projects while the current core (existing production lines in the Skellefteå factory) has delivered far below expectations (and therefore earned much less money than expected). Parts of the media and even management sometimes try to spin this as a consequence of "people not wanting to buy electric cars anymore," but we have full order books, and if Northvolt Ett had produced more in line with expectations, we wouldn’t be in this situation now.

Procurement: Poor quality in cabling, safety features, software, etc. This is largely true and is a result of differences in Swedish and Chinese corporate cultures, as well as clear shortcomings in Northvolt's procurement process. We’ll likely revisit procurement issues in other posts since it’s a major reason for the current problems, but in short, we’ve sent Wuxi Lead incredibly poorly written, vague specifications. They then installed some cheap cables they think are good enough but would never be accepted under normal conditions in Europe. When our staff traveled to China to give the machines the green light to be shipped to Skellefteå (each individual machine must be approved by the customer per contract, which is standard for this type of purchase), either they missed the poor cables, or they flagged them as unacceptable, after which some middle manager approved them anyway to avoid missing a deadline. You get what you ask for and what you pay for, and what you sign off as "OK to ship."

Lack of expertise: What’s been written in the media about 25-year-olds with the title 'Senior Manager' is also partially true, but it’s also a consequence of a flawed corporate culture, and the fact that the necessary expertise simply doesn’t exist in Europe at all.

Remote control of machines: I do know of incidents where some Chinese engineers (those Wuxi Lead flew over to help set up the machines, which is also standard for this type of purchase) got frustrated with our bureaucratic process for giving them network access and set up their own sketchy Wi-Fi router on the factory floor to bypass it. However, these were isolated incidents over several years, and they got a real slap on the wrist for it. There’s also limited remote control of machines during commissioning, but 90% of it is done by people physically on-site and monitored by us (we have to approve access for each individual person every X days, etc.).

Lack of knowledge transfer: It’s not true that the machines don’t have English translations—they do, though sometimes poorly. However, the engineers flown in from Wuxi Lead almost never speak English at all, so yes, when they come and fix problems that stop the machines, it’s often hard for engineers and production staff to understand exactly what they did and how we can fix it ourselves. That’s where the knowledge transfer breaks down, but it’s no conspiracy.

Documentation: This is also partly true. I assume it’s a Chinese corporate culture thing—they seem very afraid that we’re going to "steal" their stuff when we just want to understand enough to get the machines to work. My experience is that individual engineers from Wuxi Lead that we’ve worked with on the floor don’t care as much and help us, explaining and showing things when they can; it’s more of a corporate stance from Wuxi Lead. For example, they have some tool on their computers that makes it impossible for them to share files with us unless they’ve been approved by an office in China. However, per our contracts, they must provide us with drawings and source code when the machines are legally handed over to us, and this has happened in many cases, though they are absolutely reluctant. We’ve had entire production lines where the handover has progressed to the point that we’ve made our own optimizations and improvements in their code, re-routed cables ourselves, and other adjustments to make the machines run more stably.

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here

Pretty fascinating look into the sausage-making. The emphasis of going too fast and getting out over your skis really resonates with me, people try and translate corporate culture from other sectors like software into batteries and it just absolutely does not work that way. Batteries are a slow grind, slow and steady wins the race. "Move fast and break things" in this industry means "if you try to move fast, you'll be broke".