Recapping 2025 for Batteries

Happy Holidays from all of us at Intercalation Station. The world changed a lot for the battery industry in 2025. Last year when we recapped 2024, Northvolt was still going and the IRA was still fully in place in the USA.

Thanks for reading Intercalation Station this year, it’s a real privilege to be able to deliver the kind of high quality, technical journalism that we aim for and we’ve loved every minute. If you have any comments, suggestions or want to pitch an idea, get in touch! We’d love to hear from you. ❄️ ☃️

Europe, the USA and China: Economics, Politics and Exports

It’s been a rough year for manufacturing in Europe. Northvolt filed for bankruptcy in March, leaving $5.8 billion in debts. In August, most of the key assets were acquired by Lyten, a US based lithium sulfur start up for the bargain sum of $200 million. Northvolt faced operational mismanagement issues, several deaths later ruled unrelated to the workplace, and the simple problem of trying to solve everything everywhere all at once. Battery production is genuinely very difficult.

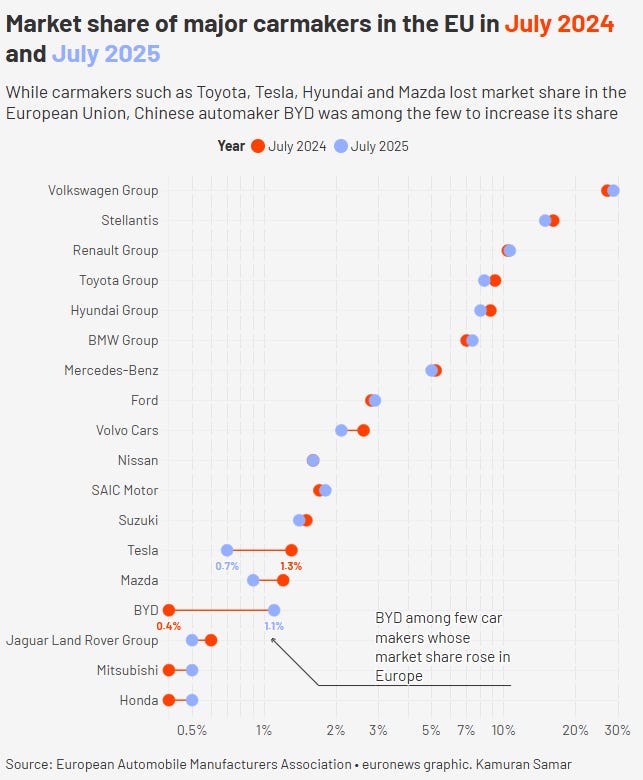

In September, European companies Verkor, ACC and PowerCo put out a joint statement urging the EU to offer ‘immediate targeted support for production’ through supported funds. The EU now seems poised to water down the 2035 ban on new internal combustion engines due to lobbying from the car industry. They are calling for the time to ‘build the necessary charging infrastructure and introduce fiscal and purchase incentives to get the market on track.’ The sector is struggling from a storm of Trump tariffs, competition from China and the cost of transforming their production to meet the rules for electric vehicle adoption. Relaxing the ban however would likely hand the advantage to Chinese companies, as argued by many including Polestar and Volvo. A short term relaxation on the ICE ban may well just ensure long term collapse of the European car market, let’s hope not.

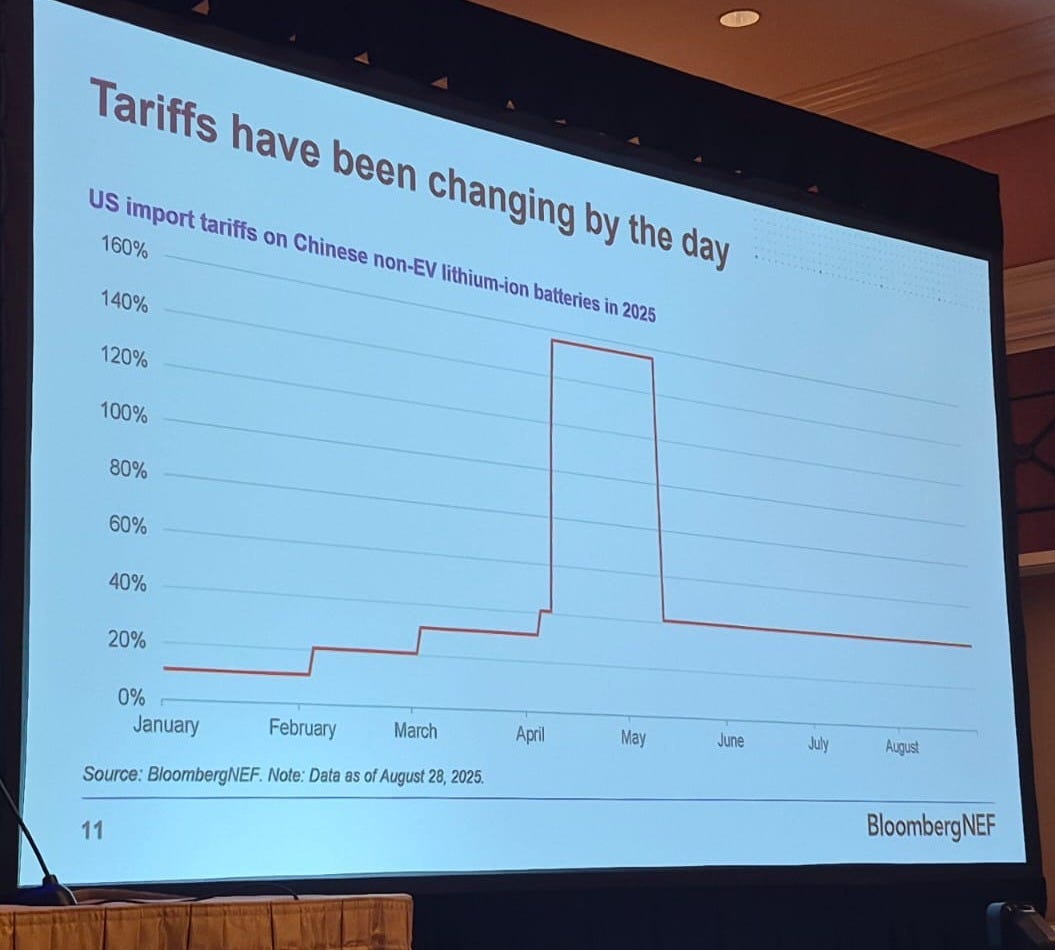

Meanwhile, the challenges in the USA are less about mobilisation of funds, since the IRA had provided a boost to funding, and more the volatility of the political landscape. The Trump administration took power in January, stripping back support for renewables and batteries, in a whirlwind that’s been hard to keep up with. In May, 24 clean energy grants worth $3.7 billion were cancelled by the Department of Energy, and the ‘Big Beautiful Bill’ passed which is slated to increase energy costs for all American households by 7% in 2035. In June & July the government passed the Reconciliation Bill, ending a load of tax credits for residential solar, EVs and wind. That’s before we even talk about the US tariffs that have been very changeable this year…

Not only have they ended subsidies, but the crackdown on immigration led to a raid of the LG Energy Solutions & Hyundai plant in September, with 457 workers arrested. Likely this will not have made Korean workers keen to come and held the US build battery plants.

The partnership between Korean SK On and Ford for three battery factories has been dissolved. The ownership of the plants has been split and operations separated due to the slowing of American EV demand. This is part of a wider strategic pivot from Ford, writing off $19.5 billion in response to weakened EV demand because of Trump’s policies. This has included ending the production of the Lightning electric truck, despite it being the best selling electric truck in the US, due to its low profitability for the company.

The US have also majorly overhauled the Department of Energy, including removal of offices such as Office of Clean Energy Demonstrations and renaming of The Office of Fossil Energy and Carbon Management (FECM) to its new name the Hydrocarbons and Geothermal Office (HGEO). There was a nice summary on Linkedin by Danielle Lemmon.

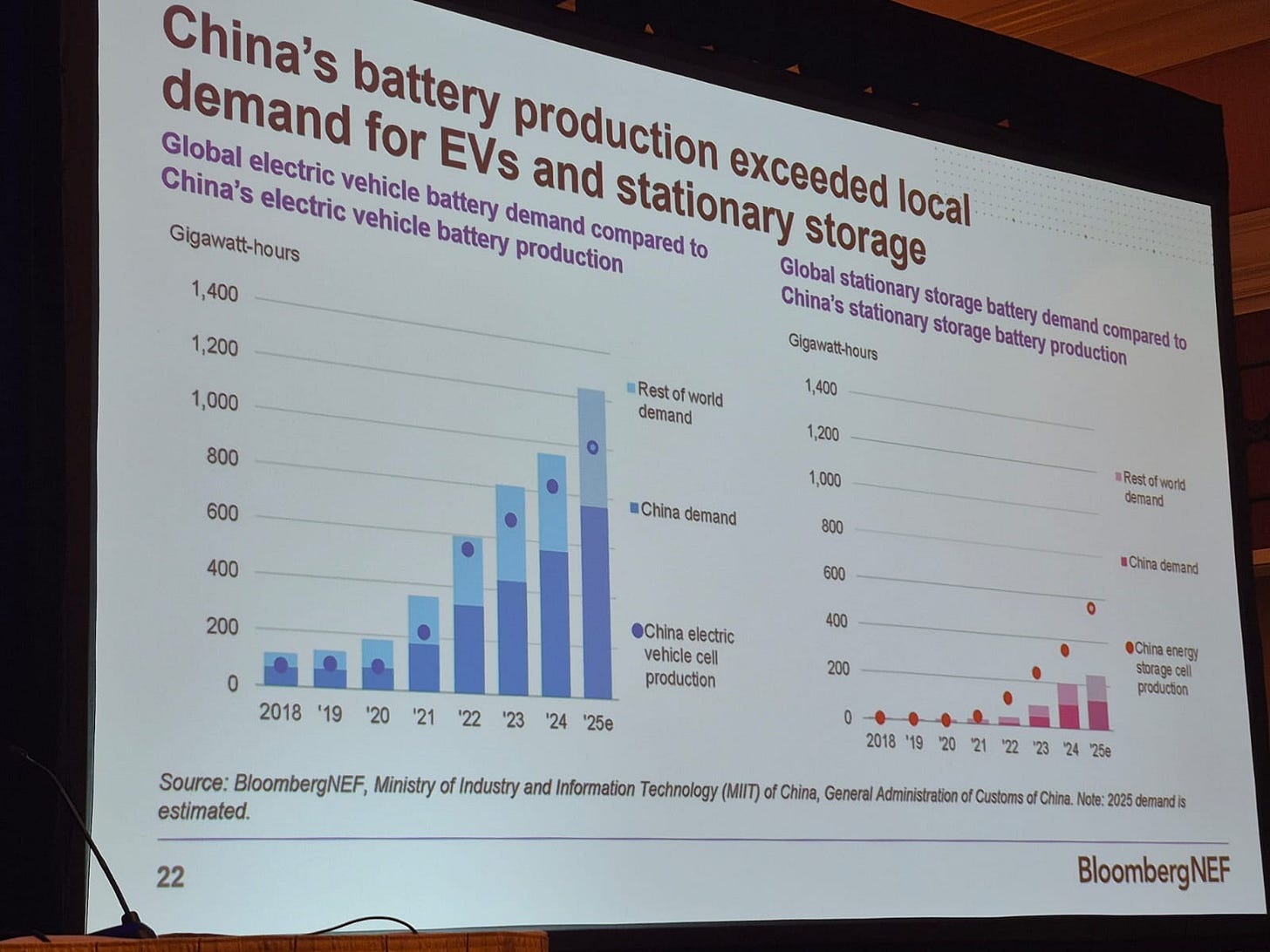

The Chinese government has also spent 2025 gradually toughening its exports on battery and related technologies. From lithium extraction to LFP synthesis technology, battery production equipment to anode materials, the Chinese government is no longer accepting US hostility without retaliating.

Chinese battery companies across the value chain are experiencing shrinking margins and consolidations. Surplus and oversupply has led to excess competition, meaning large companies are already swallowing smaller ones in a bid to stamp out this competition. It’s possible that a crash is coming for this industry, and maybe soon.

Critical minerals are a hot topic… finally

China still refines the majority of the world’s critical minerals, giving them control over key building blocks to many of the world’s technologies. The IEA found that for 19 out of 20 strategic minerals assessed, China had an average of 70% global market share over refining. This is generally discussed in one of two ways: firstly control, which China has all of at this moment, and secondly exploitation, as countries are plundered for their natural resources without their own populations feeling the benefits.

Whilst the US government isn’t keen on subsidising battery technologies anymore, at least not to the same extent as the IRA, they have become extremely interested in minerals needed for technology, in particular defence. Trump signed an executive order to expand critical mineral production using wartime powers, as well as one to speed up deep sea mining. We’ve been diving (here and here) into deep sea mining with a third part to come in 2026. The US Department of Energy also took a 5% stake in Lithium Americas and the Thacker pass project. Relatedly, Europe’s first commercial direct lithium extraction plant is now up and running in the UK, producing lithium carbonate from UK sources.

Zimbabwe announced plans banning the export of unprocessed lithium concentrates from 2027. This means that companies will have to build plants and upskill people in Zimbabwe. This happened before in Indonesia, now a leading processor of nickel.

Back in February, the DRC where most of the world’s cobalt comes from, imposed temporary export bans in response to the metal price falling. As of mid October, these have been replaced by annual export quotas, limiting the amount of cobalt exported by different players in a bid to stop companies stockpiling their inventories. We spoke to a researcher in the DRC back in February to understand a bit more about life there.

The recycling end of the market is struggling - in May Canadian battery recycling giant Li-Cycle declared bankruptcy. American Redwood Materials also laid off 5% of their staff, but after a $350 million raise which may be more of an investor request to ‘lean’ the business.

Big themes of 2025

Don’t talk about the climate!

Clean tech projects are pivoting away from climate change as a mission to defence. We are seeing that across the spectrum from minerals to batteries for drones. Kush wrote about what the military needs batteries for back in September.

Faster and Faster

BYD launched an ultra fast charger this year, which Gaël covered in great detail for us back in April. Watch out for increasingly smart engineering solutions as they come out.

Bigger and Bigger for BESS

The BESS manufacturers are in a race to the beefiest cells. EVE Energy brought out the ‘Mr Big’ 628 Ah battery cell, then Hithium announced a 1175 Ah cell, and then BYD a 2710 Ah Blade cell. More from September, and in 2026 watch for longer and longer duration systems.

Lithium Ion is King

The price of LFP cells is way too low at the moment for sodium ion to be competitive, with many predictions not showing sodium as cost competitive until the next decade. Mineral supply chains may change this, of course, but back in April we saw Bedrock materials, sodium ion battery company, close and return $9 million to their investors, and September saw a similar fate for sodium ion cell company Natron Energy, as they closed and cancelled gigafactory plans. Alternative technologies to lithium ion are much talked about, funded and worked on, but we are yet to see any of them threaten to take a chunk of the market from lithium ion.

Finally… if you need any last minute gifts or distractions for the young members of your family, Nick wrote a book!

🌞 Thanks for reading and happy holidays!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here

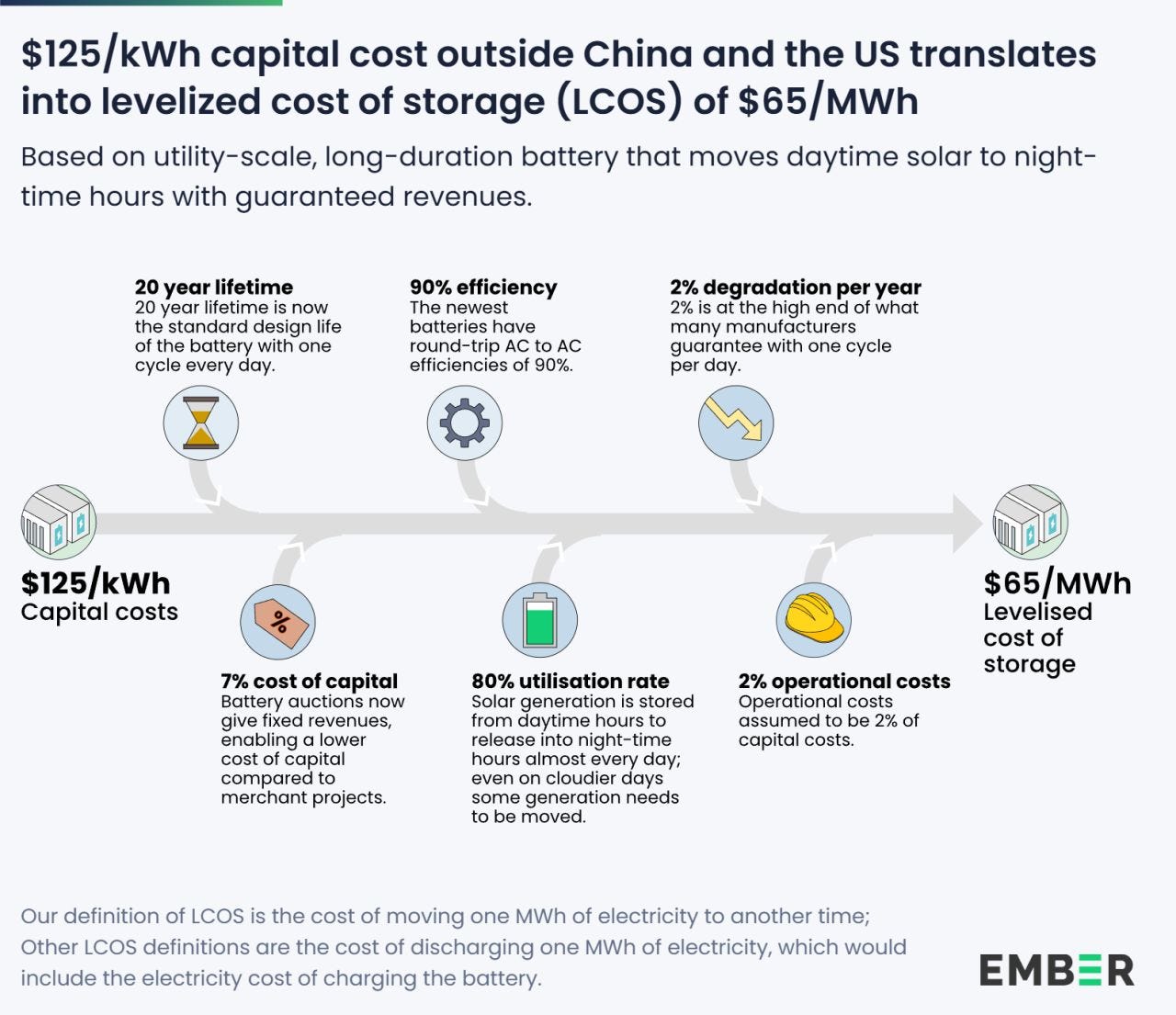

Great year-end wrap up. The BYD 2710Ah Blade cell detail caught my eye, the jump in capacity for BESS applications is someting ppl underestimate when they talk about grid storage economics. I've been tracking cost curves in stationary storage and these bigger cells fundamentally change the calculus around installation labor and system complexity. Honestly curious if western manufacturers even attempt to compete at this scale or just cede the BESS market entirely to Chinese suppliers.