Deep Sea Mining

Deep sea mining—the extraction of metal-rich materials from the ocean floor—is moving from concept to reality. In Part I of this series, materials chemist Claire Cobley examines why interest in this technology is growing, what early studies are revealing about its environmental impacts, and how shifting demand for key metals affects the case for seabed extraction.

It sounds like science fiction. Robots diving to the sea floor, collecting metal-rich rocks so that we can build a new generation of tech. Yet, this very idea is being pursued by multiple groups and has already been piloted on a 2000+ ton scale.

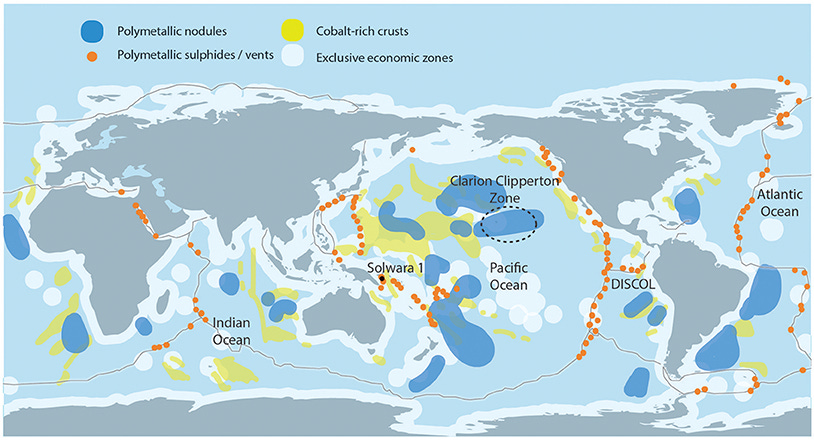

Deep sea mining is the collection of mineral deposits from 200m undersea or deeper. The idea was already proposed in the 1960’s, but has re-emerged in recent years due to escalating mineral needs driven by the energy transition.

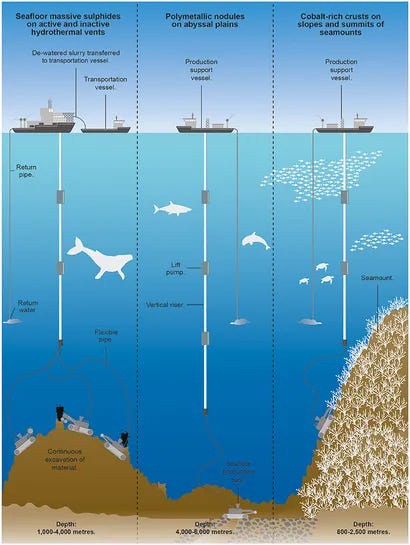

There are three main types of seafloor deposit: polymetallic sulfides, cobalt crusts, and polymetallic nodules. While the first two are layers of minerals found on deep sea vents and mountains, polymetallic nodules are loose potato-sized deposits that can be picked up easily. Their relatively simpler collection has made them the most popular choice for deep sea mining pilot studies.

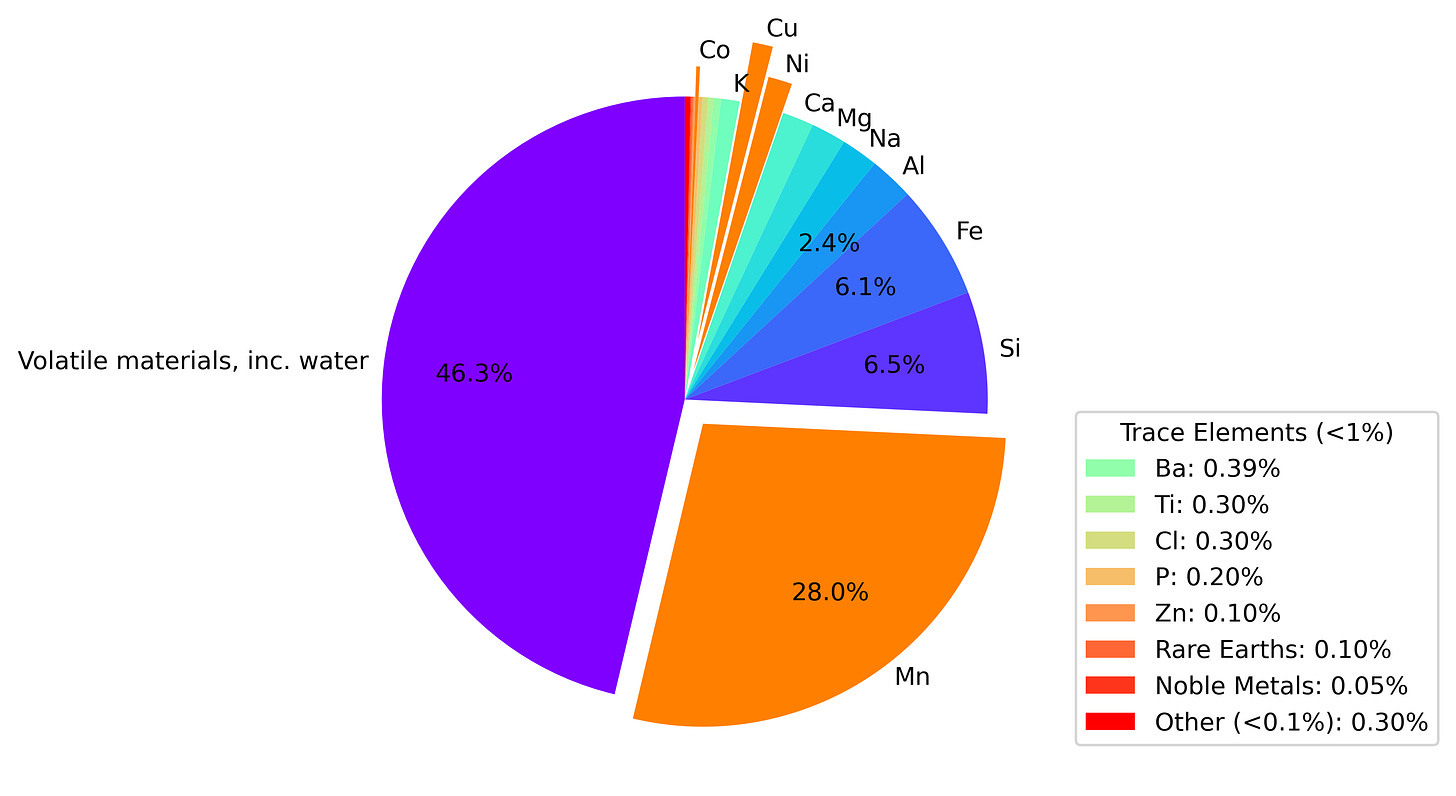

Although these nodules contain small amounts of a wide variety of elements, only four elements are under active development: Mn, Ni, Cu, and Co. Of these, Mn is by far the most abundant. Nodules targeted for harvesting in the Clarion Clipper Zone (CCZ) are roughly 30% Mn by weight, and are sometimes called manganese nodules. Nevertheless, the main financial incentives for deep sea mining come from nickel (1.3 wt%), copper (1.1 wt%), and cobalt (0.2 wt%), despite their lower concentrations.

However, as interest in extracting these metals grows, so does our need to understand the ecosystems that may be disrupted in the process.

Ecological Impact

The deep sea is referred to as the “final frontier” for good reason - we know very little about this part of the Earth compared to land. The International Seabed Authority (ISA), the branch of the UN charged with regulating areas of the seafloor in international waters, has thus mandated that companies who want to mine the seafloor collect baseline data and study the potential environmental impact.

The first scientific articles based on these studies have recently been published and hint at just how many surprises could remain. Oxygen generation was observed on nodule-covered seafloor, potentially from seawater electrolysis on nodule surfaces. This result was so unexpected that the authors initially assumed their sensors weren’t working properly, and some groups are now questioning if the evidence is sufficient to support such a major claim.

Biodiversity studies in potential deep sea mining sites have also brought to light large numbers of intriguing organisms. In one study, approximately 90% of the identified species were previously unknown to science.

Our limited understanding of the deep sea makes it extremely difficult to predict the full impacts of seabed mining. Given the scale of the proposed operations, some level of disruption from sediment plumes, machine noise, or pollution seems inevitable. Unfortunately, we still lack sufficient knowledge about the areas surrounding nodule fields to accurately gauge the extent this will disrupt deep sea ecosystems.

Moreover, the nodule collectors proposed by different companies may vary in how strongly they affect the surrounding environment. Some are developing vacuum-like systems that lift all nodules in a given area to the surface, while others are developing robots that selectively harvest only a portion of the nodules, avoiding nodules with attached sealife.

The effects of disturbing the underwater environment will also be long-lasting. By revisiting nodule-containing sites where the seafloor was intentionally disturbed in 1989, EU-funded researchers also showed that a strong impact on microbial diversity and function remains after 26 years. They estimated it would take over 50 years for some processes to return to baseline levels.

Based on these studies and others, environmental groups have sounded the alarm that the potential negative effects of deep sea mining outweigh the benefits. In addition to biodiversity loss, a March 2025 report by the WMF highlighted declining fish stocks and possible disruption to the ocean’s ability to remove carbon, as top concerns.

Increasing numbers of scientists, organizations, and countries have thus called for a precautionary pause or moratorium until the risks are better understood. The growing list also includes prominent automakers such as BMW, Volkswagen, and Volvo. So why are deep sea mining proponents continuing to press forward?

A Growing Need for Metal

Deep sea mining supporters argue that the risks of mining the seabed are justified by the urgent need for metals for electric vehicle production and the broader energy transition.

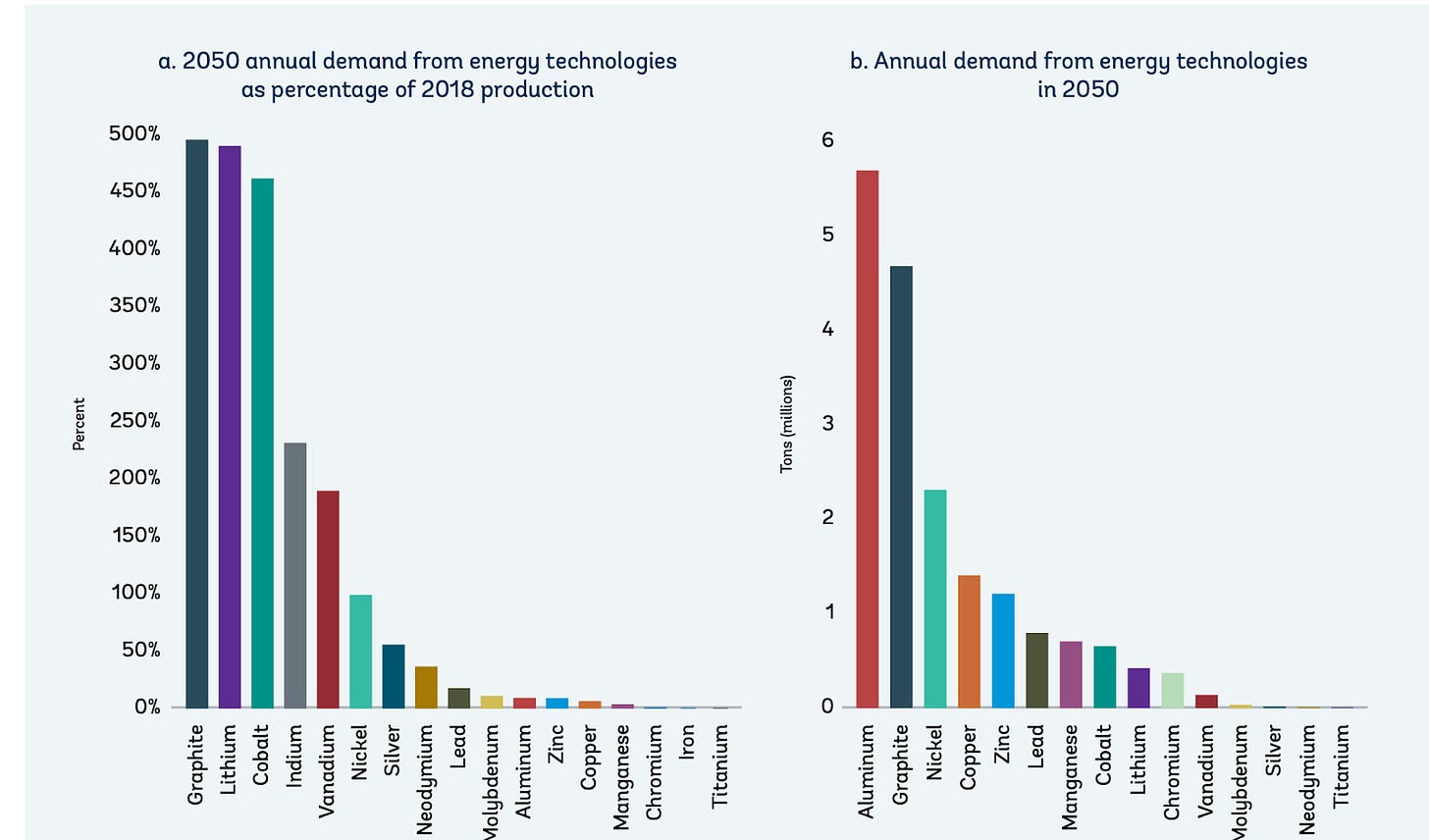

There is no denying that current projections show a rapid increase in mineral needs. A 2020 World Bank report on the mineral intensity of the clean energy transition predicted rapid growth in demand for some minerals between 2018 and 2050, driven heavily by battery materials. For graphite, lithium, and cobalt, they predicted that the demand in 2050 would be nearly 5x that in 2018. New approaches may be necessary to keep up.

However, these trendlines are not set in stone. Detailed analyses in the same report projected dramatically different demands for individual minerals depending on the pace of the transition and adoption of specific technologies.

Since the report was published in 2020, we have also seen shifts in battery chemistries that lower demand for the key metals found in polymetallic nodules. Concerns about the societal costs of land-based Co mining combined with technological advances have led to the growth of LFP at the expense of NMC, resulting in nearly half the passenger EVs sold in 2023 avoiding the use of Co or Ni. This means that even relatively recent projections of Co and Ni demand could already be out of date. Predicting 2023 demand for these metals based on 2018 trends would have overestimated the need driven by EV batteries by 50%.

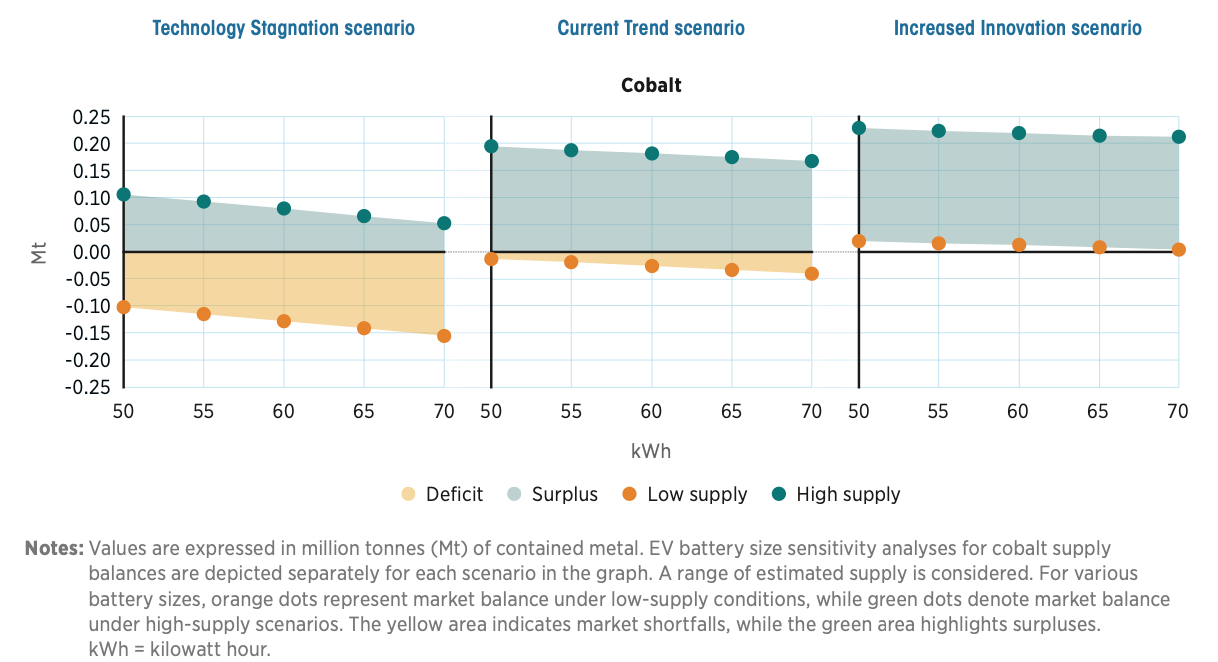

To dive deeper into this changing landscape, the International Renewable Energy Agency (IRENA)’s 2024 report on Critical Materials in Batteries for EVs compared three scenarios: (1) Technology Stagnation, in which Ni-containing chemistries continue to dominate, (2) Current Trends, with a increasing share of LFP and LFMP battery chemistries, and (3) Increased Innovation, which includes not only increases in LFP/LFMP, but also a growing share of Na-ion batteries in the mix.

Although cobalt shortages are anticipated by 2030 under the “Technology Stagnation” scenario, under the “Current Trends” scenario this possibility becomes much less likely, and anticipated shortages disappear completely with “Increased Innovation”. Nickel shortages are not anticipated in any of the three scenarios, since the rise of LFP has already reduced demand.

You can understand why one deep-sea mining company decided to publish an article highlighting “inconvenient facts” about LFP batteries.

What about the other two metals potentially being extracted from the deep sea, Cu and Mn? While EV batteries strongly influence Co demand, and have a moderate and growing impact on Ni demand, they make up only a small percentage (ca. 2-4%) of the demand for Mn and Cu. Demand for Cu and Mn will be primarily driven by power-related infrastructure and steel manufacturing, respectively.

Manganese is the 12th most abundant element in the earth’s crust, and land reserves are expected to be sufficient, despite rising demand. The situation for Cu is more uncertain, with some expressing concern about supply challenges. However, emerging mining technologies might close this gap.

Several teams are also hard at work expanding methods to reuse and recycle EV batteries. However, even if these efforts were wildly successful, and managed to achieve 100% end-of-life recovery, they would only reduce the demand for primary metals by an estimated 25% for Cu, Ni, and Li, and by ca. 15% for Co by 2050. Recycling is critical to reducing the environmental impact of our hunger for metals, but will not solve the problem alone, particularly in the short term when fewer end-of-life batteries are available for recycling.

Of course, recycling is not the only way we can reduce our need for metals, and many other methods do not receive the attention they deserve. Building housing and communities that support car-free lifestyles could reduce demand substantially and is critical to achieving our climate goals. Smaller EV batteries and continued innovation reduce the likelihood of metal shortages (see image above). Refurbishing components and repurposing batteries for less stringent applications can also play a role in reducing demand.

Although the need for rapid electrification will drive up mineral needs, when using this to justify deep sea mining, it is key to pay attention to which minerals are being discussed. Despite claims that nodules are “a battery in a rock”, deep sea mining will not help with Li or graphite shortages. While the complex interplay of supply and demand, geopolitics, and technical advances makes precise forecasts for Cu, Co, Ni, and Mn challenging even for experts, the choices we make about battery size and chemistry will clearly play a role.

In part II, we will compare the environmental impact of land- and sea-based mining as well as explore how nodules could be converted to metallic products.

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here