February 2025 Round Up

Two months into 2025 and here’s what’s happening in the battery community.

Love what we do? You can support us with a subscription 💗

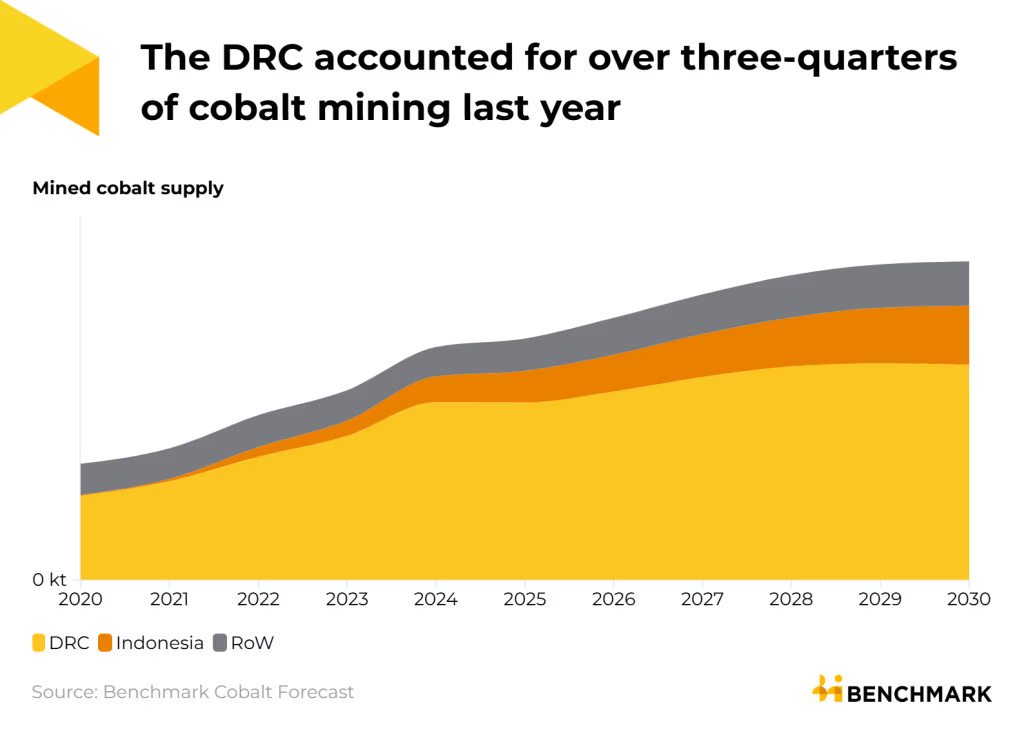

❌ Temporary DRC cobalt export ban

Exports halted from the DRC for 4 months in a bid to counter oversupply and price slump in the cobalt market. Oversupply has persisted for several years has caused low prices, not benefitting producers.

At the same time, the DRC government has banned the mixing of artisanal and industrially mined cobalt. The regulator has granted a monopoly over the production and export of ‘artisanal’ cobalt to the state owned Entreprise Generale du Cobalt.

It’s unclear how this 4 month suspension will affect the population of one of the world’s poorest countries, many of whom rely on cobalt as a source of income.

Relatedly, the UK government has also suspended aid to Rwanda over its alleged support of the rebel M23 group currently in war in the East of the DRC. You can read more about cobalt in the Congo from our recent article here.

🏭 Chinese Companies in Europe

CALB has broken ground on a €2 billion factory in Portugal, with production expected in 2028. This is the latest in serious Chinese investments in manufacturing capacity in Europe- a quarter of Europe’s battery investment now comes from China.

This includes:

CATL’s first factory in eastern Germany.

CATL €7.34 billion factory in eastern Hungary.

Volkswagen & Gotion are building a plant in Salzgitter

The Financial Times and Transport and Environment warned of the risk of Europe becoming an ‘assembly plant’ for Chinese batteries, stressing the need for regulations that support knowledge sharing. China is staying two steps ahead of Europe here, making investments in the EU in order to pre-empt any future tariffs on Chinese imports to the bloc.

You’ve got several major playors here: primarily German OEMs looking to hold onto their market, politicians wanting jobs in their country, policy in the EU pushing towards decarbonisation and Chinese car and battery makers looking to snap up some EU market share. Add into the mix uncertainty with US trade relations and it’s safe to say that Chinese battery manufacturers embedding themselves in the EU will probably be reciprocally a good thing for the EU and China long term.

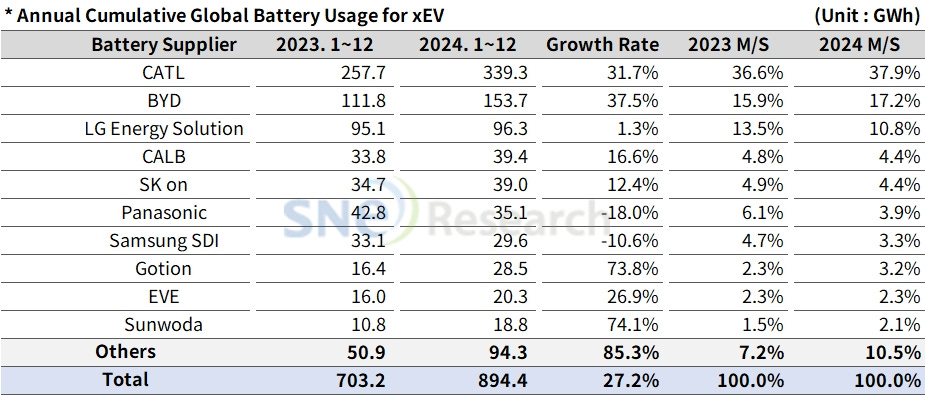

🇰🇷 Global battery market share dips for Korea

The increasing market dominance of LFP is causing Korean companies (who typically make nickel based chemistries) to lose market share steeply, falling from 24% in 2023 to 14% in 2024. Chinese companies expanded their dominance over the market. LG remained the 3rd largest company in the world, but Samsung shrunk considerably.

Korea’s contraction is blamed on decline in demand from OEMs in Europe and North America, whilst China’s own market continues to grow and be supplied by Chinese companies. In response, LGES, SK ON and Samsung are throwing themselves into innovation to chase an advantage, with LG unveiling the ‘4680’, SK ON set to unveil a high-voltage mid nickel chemistry and Samsung focusing on fire prevention.

🦅 US Production Updates

Kore Power has cancelled its plans for a $1.2 billion plant in Arizona, and is selling the site. At the same time, the CEO announced he is stepping down and the company is restucturing. The news is the result of a series of setbacks, including not quite securing an $850 million federal loan before the change of administration. Without this in the bank for construction costs, and with those costs climbing due to the economy, it was decided to axe the Arizona plans.

Kore is now looking for existing factories in which to retrofit a battery plant, which should save time and money if the right facility is found.

Tesla has started production at its Megapack (BESS) factory in Shanghai, its first outside the US.

🍬Tidbits

🔋 A study at Stanford has found that EV batteries may last up to 40% longer than expected, as real world conditions are much more favourable to lifetime than lab testing.

❓ Freyr rebrands as T1 Energy… You may remember the former Norwegian company that had ambitions to make 24M Technology thick electrode cells in the Arctic Circle, now with plans to become a vertically integrated solar and storage company from Texas. Whiplash!

🚗 Renault has developed an EV fire suppression system, placing and adhesive disc which dislodges with fire hose water pressure, allowing water to spread to all cells. They are making the patent freely available for wider use.

🧈 A novel way to separate black mass in recycling has been developed at the University of Leicester using vegetable oil!

👣 UK battery firm VOLKLEC has taken the first step towards a gigafactory, but using a stepwise approach starting on the MWh scale at an existing UK facility, licensing tech from Asian battery supplier FEB. Let’s hope this plays out to be a smart move.

🎧 What else we're reading and listening to

Long Form February hit Intercalation this month with two pieces from Gaël on Venture, battery software and coffee: part 1 and part 2. Issy took you to the DRC to hear about cobalt in the Congo. Nick went to the annual Volta battery report launch.

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here