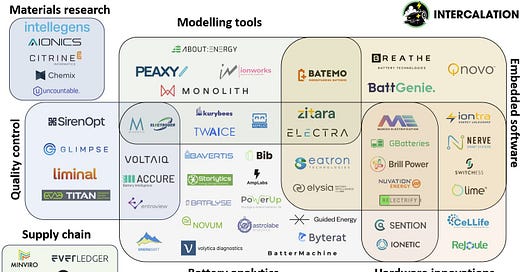

Welcome back to this series on venture-scale battery companies with Gaël!

In part 1, I mentioned that a growing theme in VC is that hardware is becoming more attractive compared to pure SaaS solutions. In particular, companies that can combine the advantages of software (fast iterations) and hardware (deep moats) by becoming vertically integrated could make the venture-scale companies of the 2020’s. I then drew a parallel between battery software and coffee to explain the current prevalent business models in battery software : the equivalent of a coffee shop business model would be a cloud model, the coffee machine business model would be the hardware model, and the coffee beans business model would be the software layer model.

I then made a comparison with the Nespresso capsule business model, which I think illustrates well the difference between modularization and vertical integration in the coffee market.

(If the parallel is not clear, don’t hesitate to (re-)read part 1!)

So, what would be the equivalent of Nespresso in the battery sector?

I think this comes back to the basic premise of part 1, which is a company that integrates both hardware (the coffee machines) and algorithms (the grinded coffee). But more importantly, develops the operating system that ties them together (the capsules). And masters all three and executes well on all three, in order to demonstrate the value proposition.

But is this really the winning model in the battery sector? I will go through:

Vertical Integration is hard

Modularization is appealing, but…

Integration versus Modularization

Conclusion

Vertical integration is hard

The 7 main difficulties are summed up in Vertical Integrator part 3:

It requires building at least two companies: software and hardware.

Hardware by itself is just really hard.

Incumbents are good at what they do and have advantages.

Figuring out the right level of integration is not obvious.

You can’t pivot nearly as easily.

Something better might come along.

Getting to revenue takes a lot of money.

Interestingly, an old article ‘A Survival Strategy for Battery Startups? Think small, says Envia Systems.’ from 2010 is a good illustration of the points above, I think:

What's the biggest problem facing battery startups?

It might be ambition.

To break into the battery business, startups have focused on designing, manufacturing and selling their own lithium-ion or rechargeable zinc batteries. Unfortunately, it's a high-risk, capital-intensive endeavor that requires scientific creativity and engineering breakthroughs. Most companies fail in the early stages.

That would be difficulties 2) Hardware by itself is just really hard and 4) Figuring out the right level of integration is not obvious.

And the ones that succeed face even a more daunting task: competing against giants like LG and Toshiba that have extensive R&D teams, worldwide sales channels, strong links with government officials, friends at car companies (they sell chips to automakers already), and factory capacity that could cover several football fields. Plus, they've got the financial resources to allow them to lose billions during temporary downturns.

This would be difficulty 3) Incumbents are good at what they do and have advantages.

History proves this out. A123 Systems lost the contract to provide batteries to the GM Volt to a joint venture largely controlled by LG Chem.

A123 is, indeed, a good example. More recent ones could include BritishVolt and Northvolt. Northvolt spread itself too thin, exploring NMC, sodium-ion and Cuberg’s technology at the same time, and trying their hands at stationary storage and recycling in addition to the EV battery they promised. So, again, 4) Figuring out the right level of integration is not obvious (or in that case staying focused is important) but also 5) You can’t pivot nearly as easily so initial choices and focus matter a lot. Finally, they probably underestimated the rise of Chinese LFP batteries, especially in stationary storage illustrating that 6) Something better might come along.

So yes, Vertical integration is hard. An alternative would be to go towards modularization, or supplying skills, services or components to large incumbents who lack the time to develop these in-house.

So what do you do? Envia Systems founder and CTO Sujeet Kumar argues that the answer for battery startups lies in licensing their technology or acting as a component supplier to the big guys.

Modularization is appealing, but…

The thing is, modularization does sound appealing to startups, but it’s not necessarily a winning strategy. And indeed, just 2 years after the “Think Small” article Envia collapsed :

Envia would develop and provide the cathode for the next-gen Volt in 2015--with the aim of a 200-mile range. […] GM found it couldn't replicate the high energy density, […] while it would hit the targets initially, energy density subsequently plunged over following charge-discharge cycles. By 400 cycles, performance was down to half. […] Kumar responded by saying the timeframe given wasn't realistic.

There are two overarching problems with their modularization strategy, in my opinion:

How do you get to venture scale as an equipment manufacturer for incumbents?

As Ian Rountree put it in Full-Stack Deep Tech :

Would SpaceX be where it is today if they’d settled for selling engines to ULA? What about Tesla if they’d been a contractor for Ford and GM? […] No chance [Anduril] would be valued at $8B in a bear market if they were a sub rather than prime defense contractor.

Would BYD and CATL be where they are today without massive ambition and a will to vertically integrate the whole battery value chain in-house? So, while Envia Systems was right to pinpoint the difficulty of vertical integration in 2010, it is far from obvious that the right take-away is that ambition is bad. The right take-away is, I believe, that it's important to stay hyper-focused in the early stages but you should still have ambition, and bake this ambition in your company culture and roadmap.

It’s difficult specializing in one part of a system when the system itself is evolving.

A battery is fundamentally a system. It’s difficult to design cathodes in a vacuum, without also giving thoughts to the electrolyte, the anode and the ultimate application. This is made all the more difficult when all the other parts, and the applications of the system themselves, are in constant evolution. So it's critical to bake system-level thinking (more on this later) in your company culture. This, I believe, implies to have both hardware and software components.

Integration versus Modularization

So, what’s the right strategy?

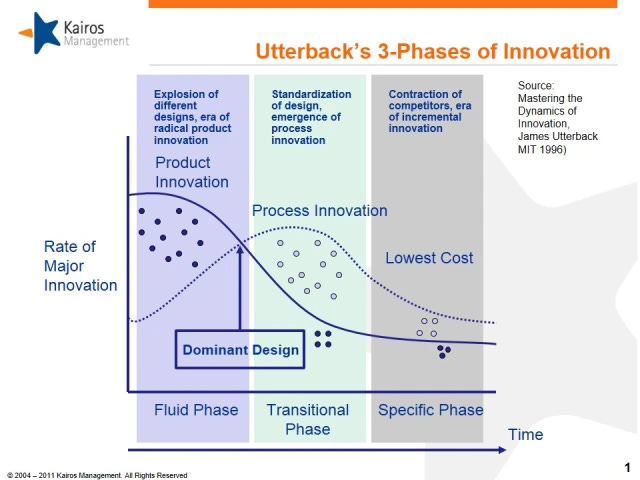

I think there is a sort of cyclical nature in the advantages of Integration versus Modularization : in an industry where disruptive technologies are emerging, the skill base is not there yet and supply chains are underdeveloped, integration is the winning model. In a mature industry where the processes are figured out, the skill base is established, and cost efficiency becomes the main driver, modularization becomes more appealing. Until a new integrated company disrupts the existing processes, that is.

One example of such a dynamic playing out would be the car industry : most car manufacturers of the early 20th century were progressively bought out by today’s giants, such as GM, Ford or Porsche. The rate of innovation was initially high (see figure) so vertical integration was a better model. But as the car market matured and standardized, the rate of innovation decreased. It started making sense for these companies to rely on highly specialized parts suppliers to bring the overall cost of the system down. Modularization became a better model.

That is, until EV companies came onto the scene and disrupted the car industry. The current successful companies in that space like Tesla and BYD are textbook examples of vertically integrated companies, as the market is not yet standardized enough for modularization to take over.

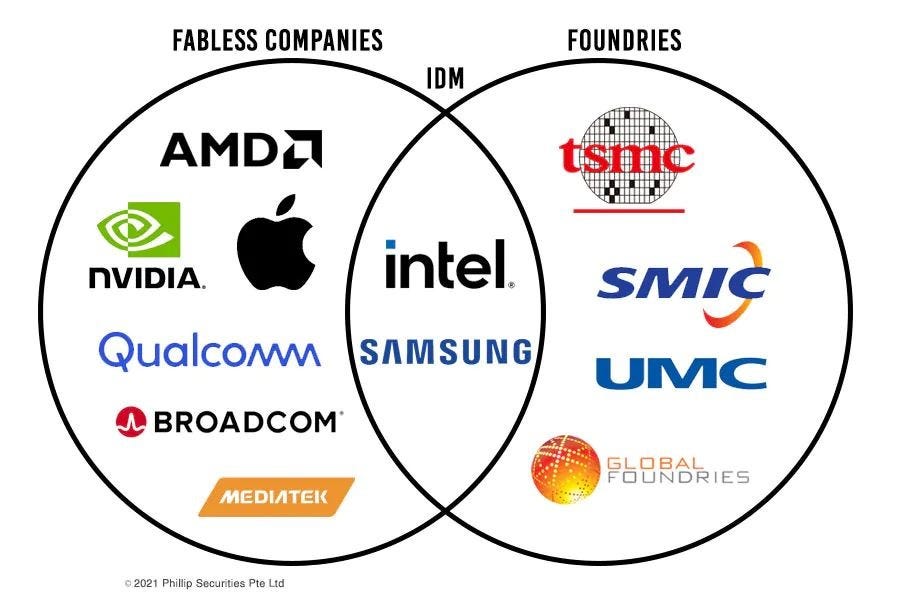

Another examples is the chip industry : the first companies in the space, first Fairchild Semiconductors and then Intel, had to do everything in-house and were vertically integrated (still today, Intel manufactures its chips in-house). Later, when the market matured, the modularized foundry model pioneered by TSMC (where chip designers collaborate with chip manufacturers) won out on value.

(By the way, I encourage you to go read Does the Foundry Model Work For Batteries? by Andrew if you haven’t already).

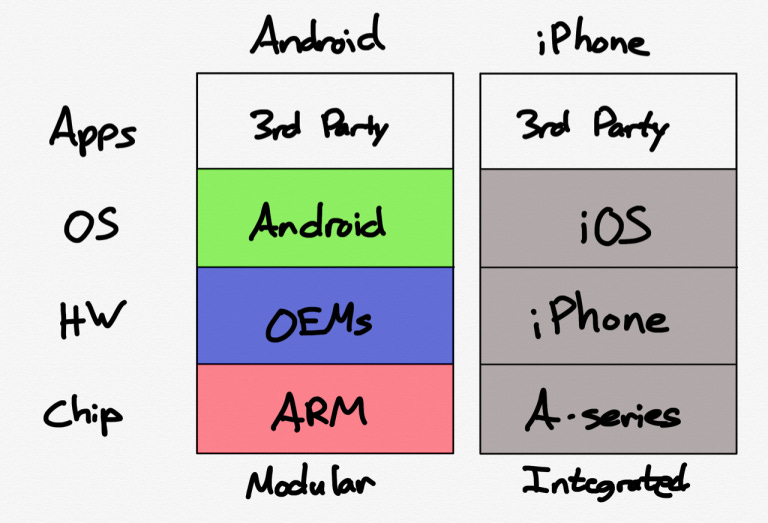

Now, it would be tempting to see Nvidia and Apple on the left part of this diagram and think “see? Two of the most valuable companies ever are modularized” but that would be wrong. These two companies are definitely vertically integrated, just upstream of the chip market. And more importantly, I think these two companies have system-level thinking at their core.

System-level thinking

Jensen summarizes Nvidia’s competitive advantages from their systems-thinking and vertical integration in this May 2024 earnings call:

AI is not a chip problem only. It starts, of course, with very good chips and we build a whole bunch of chips for our AI factories, but it's a systems problem. In fact, even AI is now a systems problem. The fact that NVIDIA builds this system causes us to optimize all of our chips to work together as a system, to be able to have software that operates as a system, and to be able to optimize across the system.

Similarly, Apple have always had system thinking at their core, as illustrated in AI Integration and Modularization by Stratechery (2024)

The issue I have with […] what I was taught at business school [about vertical integration] — is that the only considered costs are financial. But there are other, more difficult to quantify costs. Modularization incurs costs in the design and experience of using products that cannot be overcome, yet cannot be measured.

Going back to batteries and battery software, I think the cost that's baked in modularizing hardware and software is that there's a limit to the insight you can extract from low-quality, or limited data. If you specialize in software and develop extremely fancy algorithms, you’re still tributary of the data that comes out of the hardware (which you don’t control).

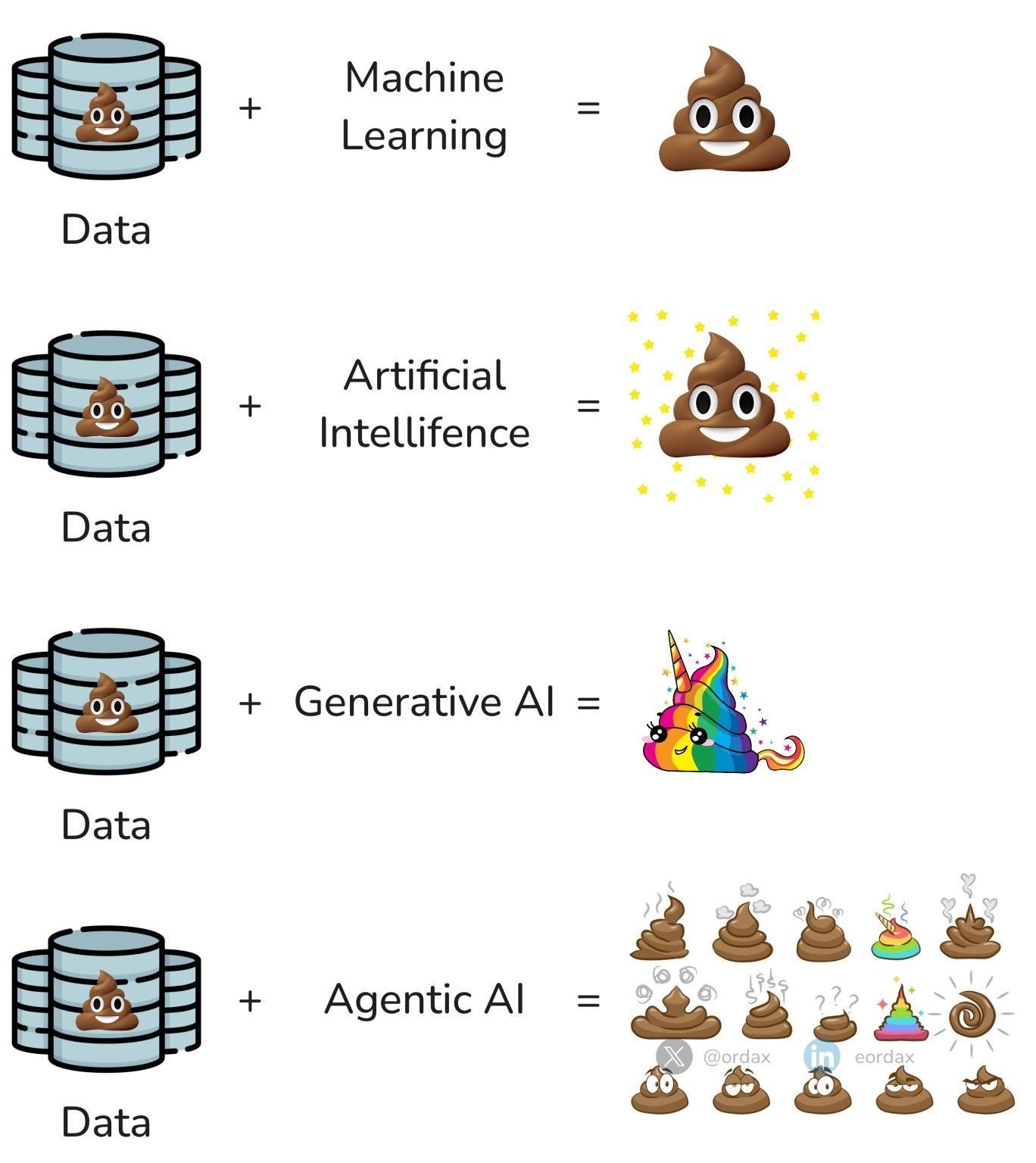

I think this is well illustrated by the following image about “rubbish in, rubbish out” :

In a BMS, if you're limited to noisy voltage and current data sampled every ten seconds, there's only so much insights you can extract from that. Same in a factory, if you only have a few basic electrochemical tests at the end of line, there's also only so much you can tell about the quality of the cells.

But if you design new hardware to go hand-in-hand with your software, the same way Nespresso has system-level thinking of coffee making, suddenly you have more data to work with and you can extract the most out of this data with fancy algorithms. AI and LLMs, if anything, have shown that large amount of high-quality data (coupled with novel architectures like transformers) can be a game-changer in algorithm performance. In my 2023 piece for Intercalation “BattGPT or AI bubble?” however, I underlined how difficult it is to generate enough high-quality battery data to train AI algorithms, the same way it worked for text, games or images.

Conclusion

To sum up, my main take-aways would be the following:

Vertical Integration is capital-intensive to start with, but can lead to better capital efficiency / system performance later on. However, it’s important to stay hyper-focused in the early stages.

Modularization is a valid strategy in a mature market where innovation rate is low and capital efficiency is the main target. However, even in a relatively immature market, it can be a good starting point for a startup.

Data quality is paramount. In a world with AI on the rise, working with high-quality data can give a valuable edge. State-of-the-art hardware is not always enough.

System-level thinking is core to successful companies, as you can make sure your hardware and software go hand-in-hand. That implies some degree of vertical integration (the degree of which is not trivial to figure out).

I think this quote from Hadrian’s CEO on the Sourcery podcast sums up well going for a vertically integrated strategy as a startup:

The risk is 100x, the reward is 100x, the pain threshold has to be 100x. It’s not for everybody.

Working with hardware is, well, hard. But it can be worth it.

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here

Great Article. I'd like to get in touch with you for a call if you are keen to discuss deeper into Ai in battery control systems.

raees@ion-x.co.za