2025 Summer Roundup - Part 1

Tariffs & major acquisitions

It’s been a long, hot summer and lots has happened. Here’s everything so far.

💰 More tariffs in the battery supply chain

What once felt like a hypothetical is now unfolding. The US government has leveled new tariffs on almost the whole world, including a bunch of components that strike directly at the heart of the electrification supply chain.

Graphite (93.5% tariff): The single largest material in most EV batteries by mass. Each EV requires roughly 50-100 kg (110–220 lbs) of graphite, used to form the anode of lithium-ion cells. Natural graphite is mined, shaped, purified (often using hydrofluoric acid), and spheroidized before becoming battery-grade. China accounts for over >90% of global processing capacity and dominates the supply of both natural and synthetic graphite. This includes finished anode products, not just the raw materials. As Kevin Shang noted, this is a “including AAM within finished lithium-ion batteries.”

Copper (50% tariff): President Trump is launching a 50% tariff on Chinese copper imports. Copper is an essential conductor in every electrical component. The average EV contains 83 kg (183 lbs) of copper. Today, the US imports nearly half of the copper it uses. While Chile, China, and Peru dominate global production, China controls much of the midstream particularly refining, where it commands over 40% of global capacity.

Reciprocal tariffs target the rest of the components: New tariffs also target lithium-ion battery parts and potentially the modules and packs themselves, depending on how US Customs classifies their composition. This will disrupt cost models for Chinese firms exporting low-cost LFP modules to the US especially for two-wheeler and stationary storage markets.

The US is using these tariffs as a mechanism to accelerate domestic reshoring. Today, US automakers and cell manufacturers are deeply entangled in Chinese materials. Tariffs raise costs across the board. There’s no US stockpile of graphite. No near-term substitute for battery-grade copper foil. It seems like the most optimistic domestic graphite projects are still years from reaching commercial scale.

If your supply chain still runs through China, you’re now paying a premium for it. Companies are reacting:

LGES inks a $4.3b deal to supply Tesla with LFP ESS batteries until 2030, supplied from LGES’ Michigan factory.

GM plans to manufacture their own cells, but will source CATL cells in the meantime.

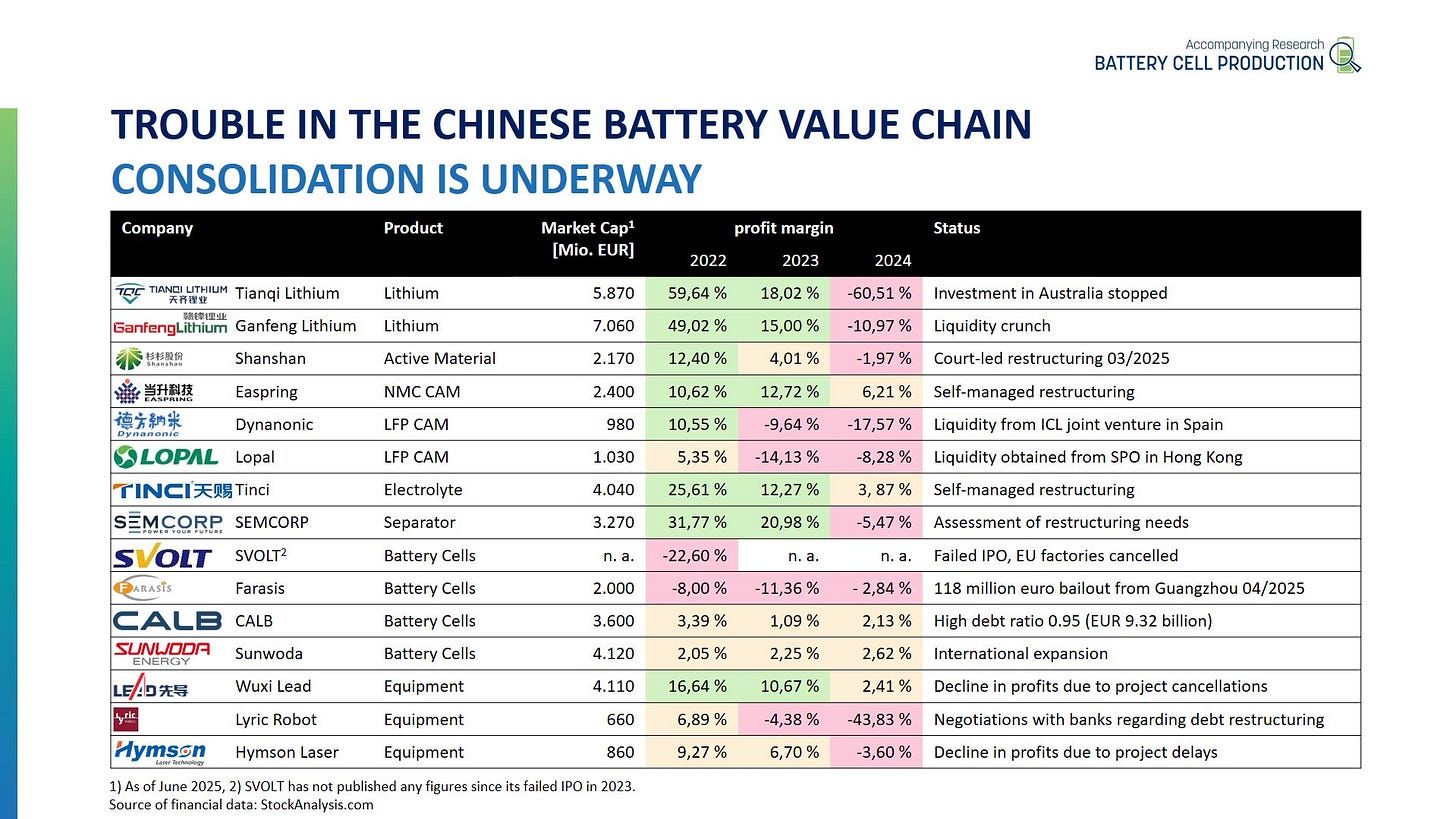

Consolidations

While low-cost production and streamlined logistics in China have given them an edge (often accused of as price dumping), many Chinese battery and materials companies are now facing shrinking margins with several operating at a loss in 2024. A wave of consolidation already underway.

🏭 Manufacturing updates

Lyten (Li-S cells with 3D graphene) raised $200m and went on a buying spree. Recently acquired Northvolt’s BESS facility in Poland and now recently acquired the rest of the $5b asset portfolio, including tooling and ESS IP. Also notably, they just laid off 45 staff (including battery legend Celina Mikolajczak), perhaps to free up cash to hire for their new portfolio. Assets under Lyten now:

Northvolt Ett (Skellefteå, Sweden): Northvolt’s flagship gigafactory. Lyten plans to restart cell production aiming for 2026 output.

Northvolt Labs (Västerås, Sweden): The advanced R&D center focused on cell chemistry.

Northvolt Drei (Heide, Germany): The planned gigafactory with an initial capacity of ~15 GWh in southern Germany has been acquired by Lyten, working with local authorities to continue the project.

Northvolt Dwa (Gdańsk, Poland): Europe’s largest BESS manufacturing and R&D facility.

Cuberg Facility (San Leandro, California): Northvolt’s Li-metal cell manufacturing facility acquired last year.

There are a lot of theories about what this all means, let us know what you think is going on in the poll:

🍬 Tidbits

🔥 On August 2, a fire at Molicel’s Kaohsiung (Taiwan) facility triggered a full evacuation and emergency response (Taiwan News). 2 million cells were lost. 16 people were sent to the hospital and operations remain suspended.

🖥️ SES AI, which recently said they weren’t making cells anymore and only doing AI and simulation software, has acquired 100% of UZ Energy for $25m, entering the ESS market for C&I applications.

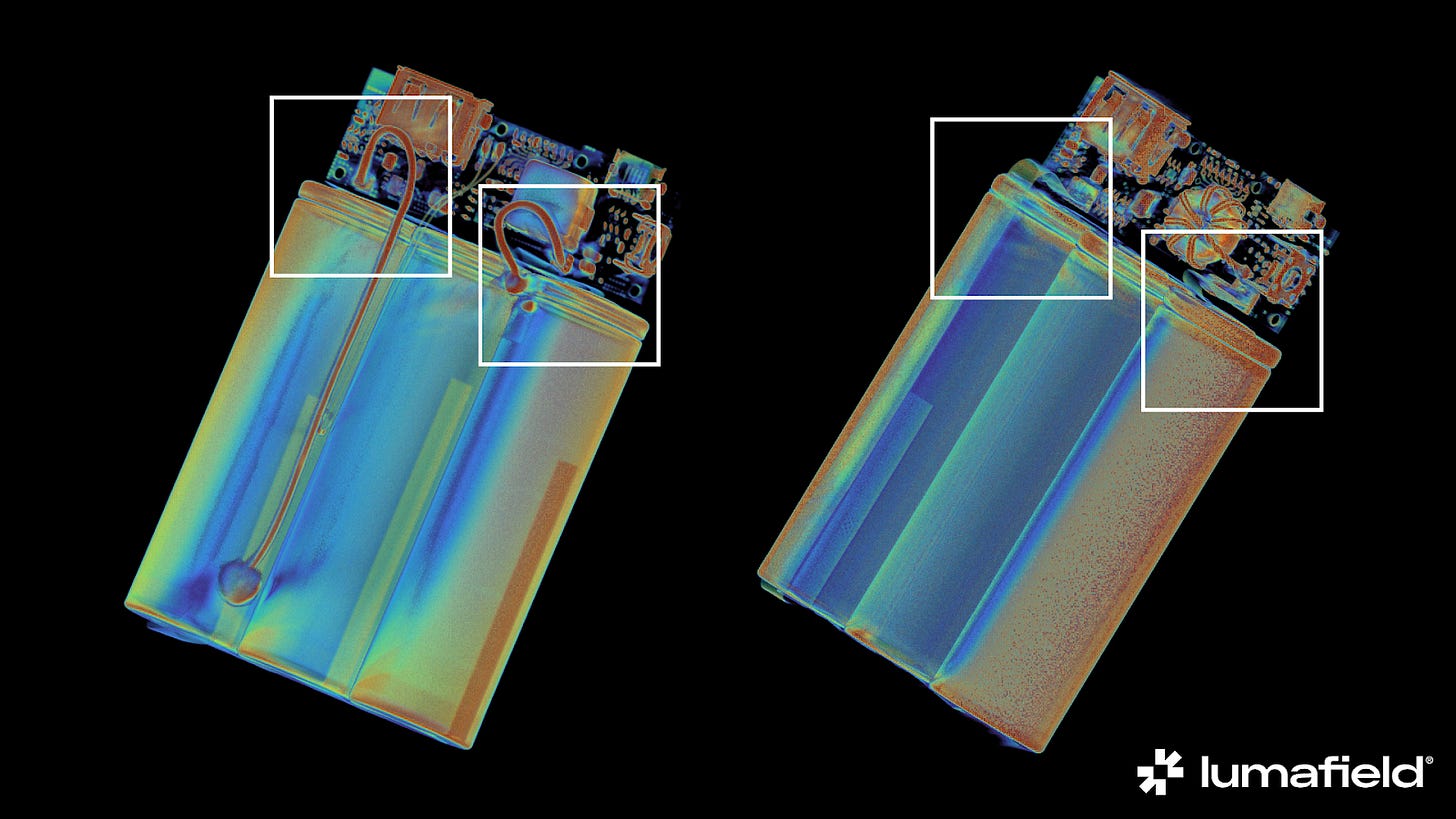

⛔ We wrote about the Anker powerbanks failures last month. Lumafield did some nice CT scans on what went wrong. It appears to be deformed tabs and short distance between positioning of positive and negative terminals increased risk of shorting. An estimate cost for the recall is roughly $34m.

Ionic Materials raises $29M Series B working on nano-silicon anode made from high-purity halloysite clay in Utah.

FlexGen scoops up Powin’s assets and IP

Group14 lays off staff at its Washington (US) plant.

Faraday Future’s FX Super One turns out to be a rebadged Chinese minivan.

🎧 What else we're reading and listening to

Sodium-ion benchmarking shows overview of the key electrochemical parameters from key players.

📰 What else we covered at Intercalation

Roman took us through the status of the Sulfur industry - part 1 and part 2 - just in time for the big Lyten news.

Nick and Melissa went to the Battery Show Asia - Takeaways from Hong Kong’s inaugural Showcase.

Nick and Darren wrote a book! My Baby's First Climate Book: Batteries

Gaël dropped the third part of a tale of three press releases part 3 : Porsche and the AC battery.

Shyam on biodiversity and batteries: we need to have a conversation about conservation.

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here