March Round Up 2025

There are now 10,000 of you lovely readers and we couldn’t be happier about it. Here’s all the interesting stuff from March.

⛽ BYD is coming for petrol

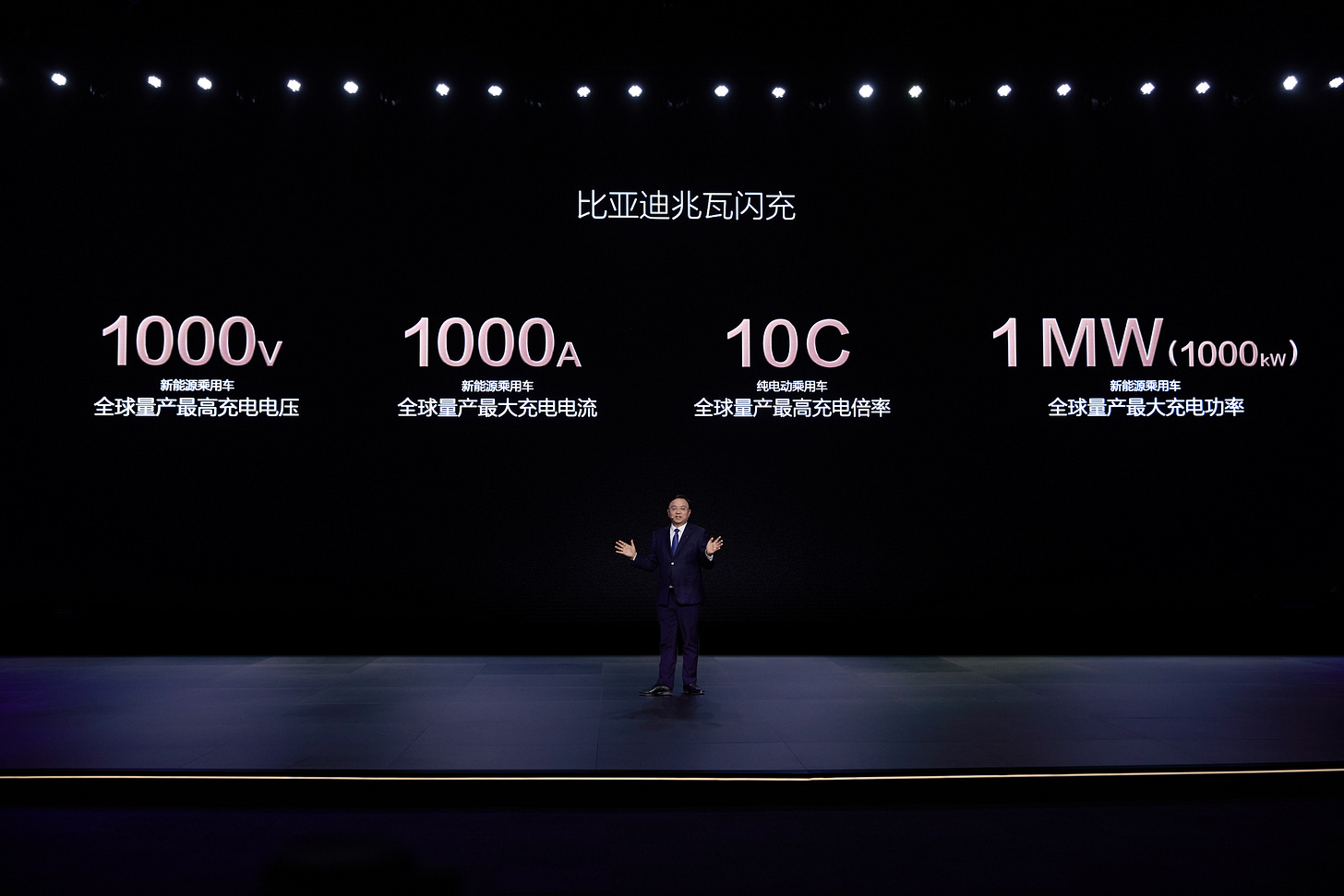

BYD are on a mission to make ‘make charging as quick as refueling a gasoline car’ and they might just be getting there. The new platform launched charges their cars at 1 MW (1000kW), which they claim gives you 2km per second charged. They have also launched a ‘Flash Charging Battery’ which is capable of charging with a current of 1000A at 10C, due to ultra-fast ion channels which reduce internal resistance by 50%. The Blade battery packs have cooling channels between cells and BMS real-time adjustments to respond to the heat generation by such a large current.

The pressure this will put on the grid is alleviated by a smaller transformer at the charging station and 225kWh battery storage buffers. All of this gives you 400km in about 5 minute charge, pretty much on par with petrol.

💫 The Next Phase

The International Energy Agency has declared the battery industry has entered a new phase. Demand is rising and prices are still falling, and in 2024 global battery demand passed 1 TWh, while global battery manufacturing capacity has 3TWh. Markets have gone from regionalised to global. The industry is now about economies of scale, supply chain partnerships and efficiency. They’re forseeing consolidation in the sector as price drops slow down.

🔥 Precursor free CAM

LG Chem unveils ‘precursor free’ cathode material for nickelate cathode materials. Whilst the press release is a bit sparse on the details, it’s likely they’re going for something similar to NanoOne a few years back with a one pot high energy efficiency synthesis, avoiding the need to handle sulfates.

The company is going to mass produce CAM this way in Korea starting this year.

🇺🇸 US updates

Tesla is planning a new factory in the Houston area for its megapacks. Megapacks are the utility scale energy storage container style product, and are currently made in Shanghai, California and Nevada.

Ascend Elements cancelled a $164M CAM grant from DOE. Last year Steve LeVine reported how 1/4 in recipients of these grants has cancelled them. Ascend Element’s overall project is still happening but the scope has been narrowed to producing precursor rather than CAM. In an oversupplied CAM market, this seems a shrewd move to go one step further upstream and be more strategically valuable as raw material suppliers.

Relatedly, Trump is expanding critical mineral production using wartime powers. The executive order uses cold war legislation to instruct government agencies to prioritise mining projects. Critical minerals are extremely important for not just batteries but also defence tech. The Wall Street Journal wrote about how even startups that started on minerals for climate tech are now remarketing themselves around defence.

The US House of Representatives has also passed a bill to restrict use of Chinese-made batteries in America. Furthermore, the Department of Energy has a ‘hit list’ of renewable energy targets it is trying to cancel that have already been awarded money from the last administration.

The new tariffs on all goods into the US are a new and emerging story, more on that another time 😅

🔙 Look Who’s Back

Former CEO of Our Next Energy has a new role, one year after being replaced as CEO, as the next CEO of Our Next Energy. The company has also announced that it completed a funding round.

ONE fired about 25% of its staff in December 2023 including CEO, but raising new funding has caused a new reshuffled.

🍬 Tidbits

🔋 Google now have 100 million lithium ion cells in their data centres.

🩻 Glimpse has raised a $10 million Series A round for their X-Ray CT scanning platform. Read more about what they do from their article with us last year.

🫧 Seattle-based Homeostatis have announced a $600k pre-seed investment for their process making graphite out of captured carbon.

🏎️ Shanghai is subsidising charging swap stations by 40% if they work across all brands, and 20% if brand specific. This mostly benefits Nio, who are the main player in battery swap vehicles.

🇸🇪 Northvolt files for bankruptcy in Sweden, but is still producing cells. Local reporting suggests they are waiting for a potential buyer, with less than 900 of the 3000 employees to remain at the factory.

👩🦽 The London borough of Camden is getting 570 ‘flat and flush’ charging points. These will help residents without drives to charge their EV, whilst not creating more barriers to accessibility for people walking and wheeling.

🎧 What else we're reading and listening to

This month we had a stellar piece from regular contributor Kush on what happens when children eat batteries. Lorenzo wrote about the challenges on second life batteries, using the parallel of Michael Jordan, and Roman took us through the costs of DIY battery pack making.

The Battery Tech Network details all companies in the battery space.

Datasets collected by Stanford university which contain calendar aging, dynamic cycling conditions and formation and fast charging protocols.

Nature article about the need for standardisation of battery testing in literature.

Linkedin opinion piece on why Lilium (German eVTOL company) failed.

🎧 Catalyst: An Ode to Electrochemistry

🎧 Transmission: Developing BESS from Greenfield to Grid

🎧 Transmission: Unlocking Italy’s battery energy storage market

🎧 Catalyst: The coming robotics wave

🎧 Battery+Storage Podcast: Cobalt, Lithium and the Quest for Sustainable Batteries

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here