January Round Up 2026

Cold, long dark days in the northern hemisphere with a lot going on. Here’s what caught our eye for January.

🇨🇦 Canada

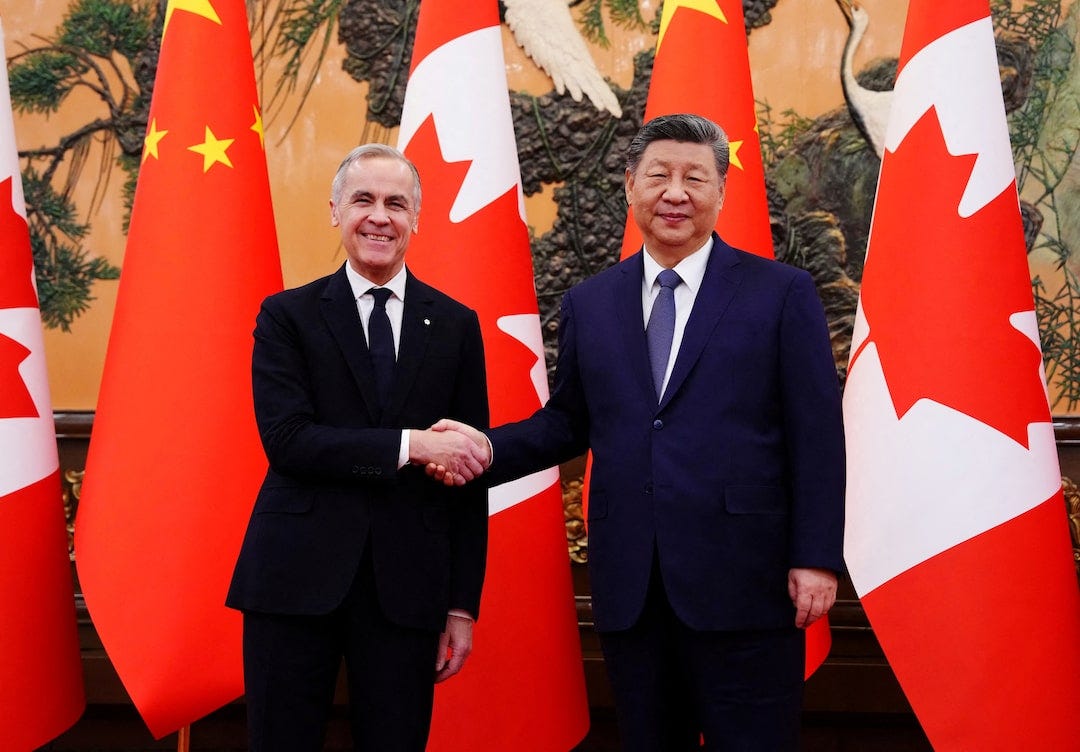

In the middle of January, Canadian Prime Minister Mark Carney visited China, the first visit of this kind since 2017. The result of this trip is a trade deal that will slash tariffs on Chinese EVs down from 100% to 6.1% on the first 49,000 vehicles per year, with the quota increasing to 70,000 in 5 years. China will also lower tariffs on Canadian canola seed from 84% to 15%, and committed to visa-free access for Canadians travelling to China. This is a reflection on the tumultuous relationships Canada has had with Donald Trump’s America, with Carney seeing China as a ‘more predictable’ trade partner, something that Chinese leader Xi Jinping has been trying to achieve.

The early winner in this new import situation is likely to be Tesla, with its Shanghai factory already able to make a Canada-specific version of the Model Y and very established Canadian sales network. Half of the quota will be reserved for vehicles under 35,000 CAD (around 25,000 USD), which is lower than any Tesla vehicles, which will give some market room for Chinese manufacturers with a more market level range.

A senior Canadian official also expressed a desire for Canada to look at joint ventures with Chinese companies to build domestic vehicles with Chinese knowledge. This is a similar route to approach increasingly adopted in Europe, welcoming factories into create jobs and attempt to transfer knowledge, which is a more pragmatic approach than out right expensive competition.

Tesla

Back in 2020, Tesla promised tab-less cells with 6x the power output of the current model at the time, that would be made in house. The cells were promised as large 4680 cylindrical cells (46mm diameter 80mm height), with multiple improvements in the process including tab-less design, steel casing and dry electrodes.

Dry electrode coating is no easy task, shown by the 5 year learning timeline at Tesla, and on the 1st February Musk posted on X that his team had made the dry electrode process work at scale. EVLithium did a neat deep dive on the whole 4680 and dry electrode process.

Relatedly, Tesla reduced a $2.9 billion order to just $7,000 for high nickel cathode materials from Korean manufacturer L&F. This has been blamed on weak Cybertruck sales, since the CAM was used for 4680s currently only used in that model.

🍬 Tidbits

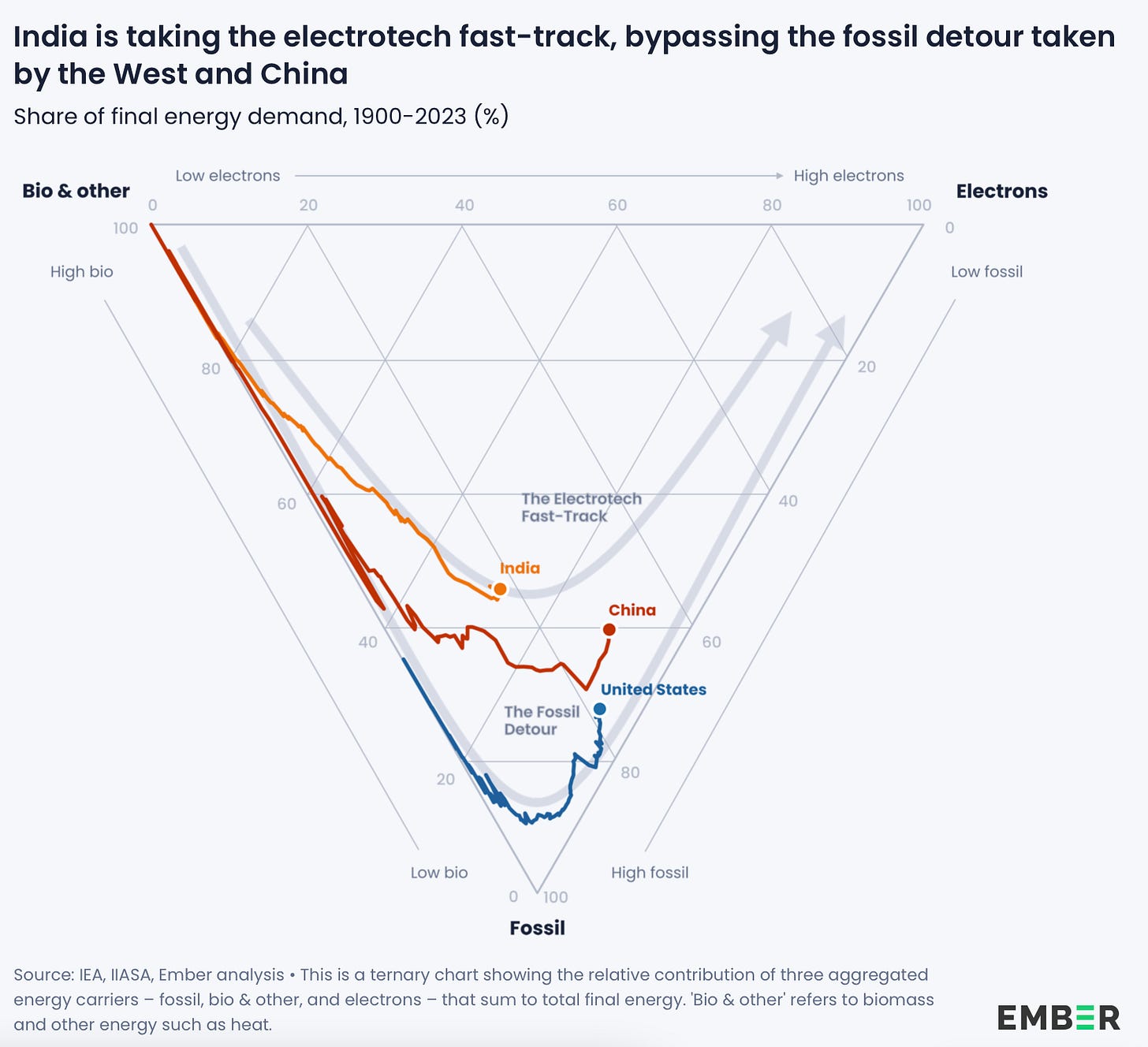

🇮🇳 Ember Energy analysis reveals that India is electrifying faster at equivalent levels of GDP than China did, with much lower coal use, rapid solar deployment, growth EVs and much lower oil demand for transport. The result of this is much greater energy sovereignty.

📷 Polaron has raised $8 million in seed funding for their AI assisted microscopy platform.

💸 Sparkz raises $20.2 million in a Series A to scale integrated LFP battery production in the US.

💰 UK based battery intelligence company Elysia has expanded its reach beyond EVs and heavy industry into the BESS market via acquisition of US company Zitara.

🧂 Material deindustrialisation is occurring in Europe at a worryingly fast yet silent pace, Ed Conway has written another brilliant piece about salt in the UK.

🏖️ Silicon in the Washington State area, where both Sila and Group14’s US activities are based, is facing challenges competing for power with data centres. Group14 has shifted its main focus to a South Korean facility. Relatedly, Amprius is expanding its US production through a partnership with Nanotech Energy.

🤝 CATL has signed a massive LFP order from Ronbay New Energy Technology to supply 3.05 million tons of LFP between 2026 and 2031, work $17.2 billion, the largest order to date in battery materials. CATL are also acquiring 5% of Fulin, another LFP supplier, to allow them to increase their capacity to 500,000 tons annually.

❌ Volvo Cars is officially cancelling its operations on Novo Energy after failing to find a technology partner, meaning that 75 jobs are being cut in Gothenburg.

🇺🇸 The US Department of Energy has announced $30 million for funding across energy technologies. The funding focus targets the 1,000 Wh/kg threshold for eVTOL, drones and robots.

🎧 What else we’re reading and listening to

Video Review of Xiaomi’s SU7 EV

What a Tour of China’s Factory Floor Reveals About the Future of Clean Energy by MCJ on Linkedin

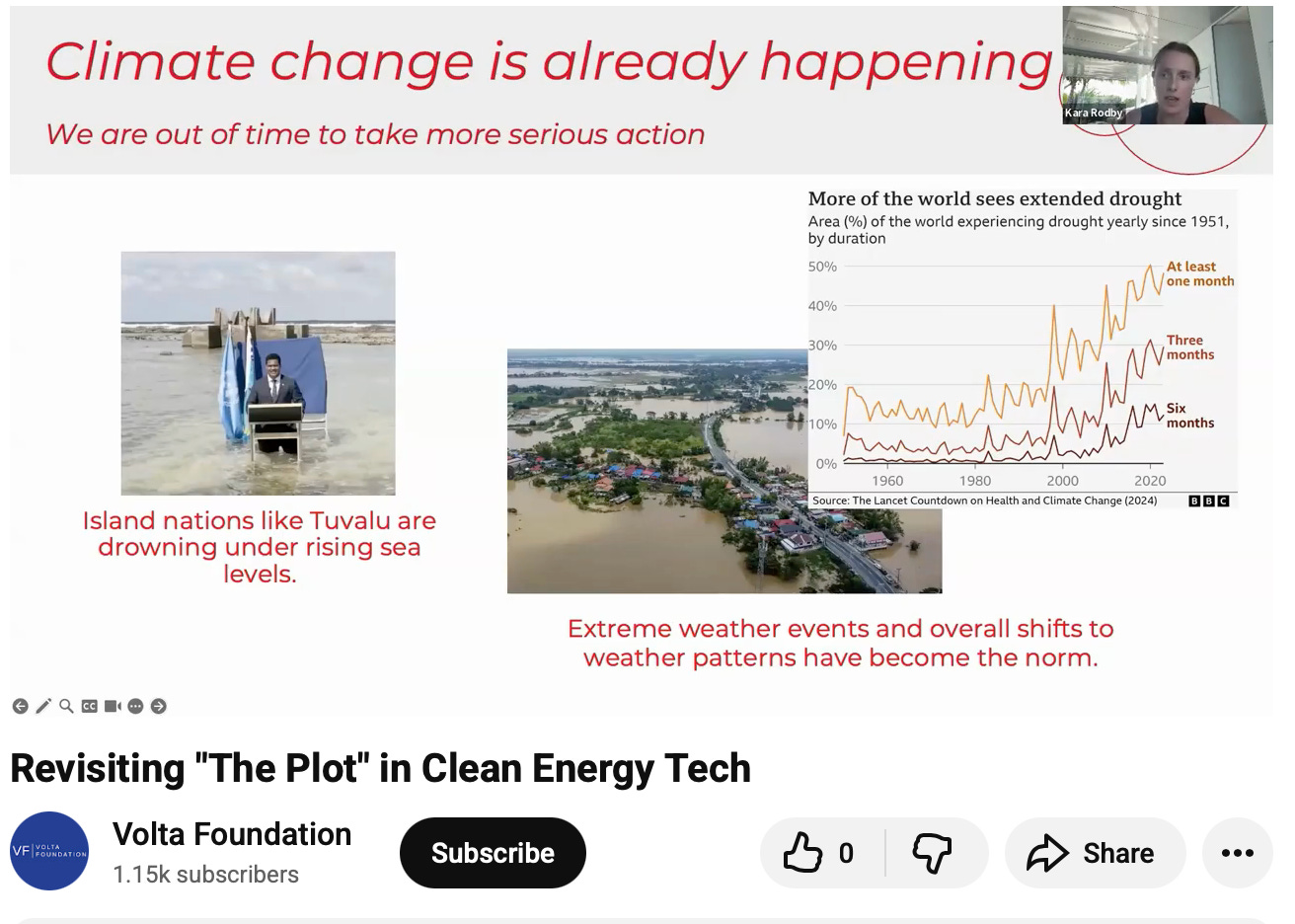

Kara Rodby gave a slightly different type of talk this month at the Volta Foundation’s online battery networking session on ‘Revisiting the Plot in Clean Energy’ about whether the "free market" approach driving the West's climate change abating efforts is working or whether it is set up to fail, and what we should be doing instead. It’s very though provoking and we highly recommend a watch!

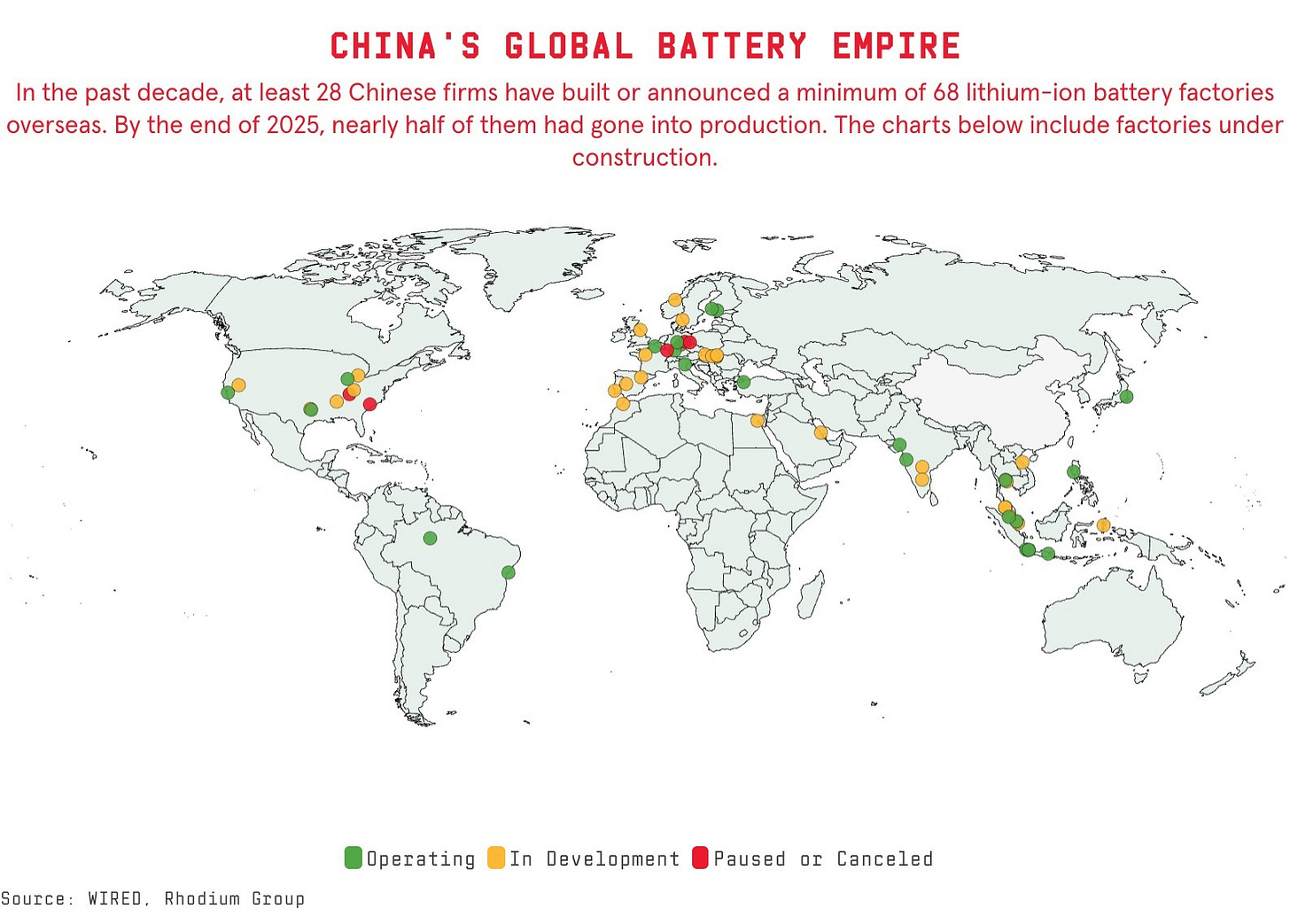

What happens when a Chinese Battery Factory comes to town, by Wired, complemented nicely here by some graphics by Zeyi Yang.

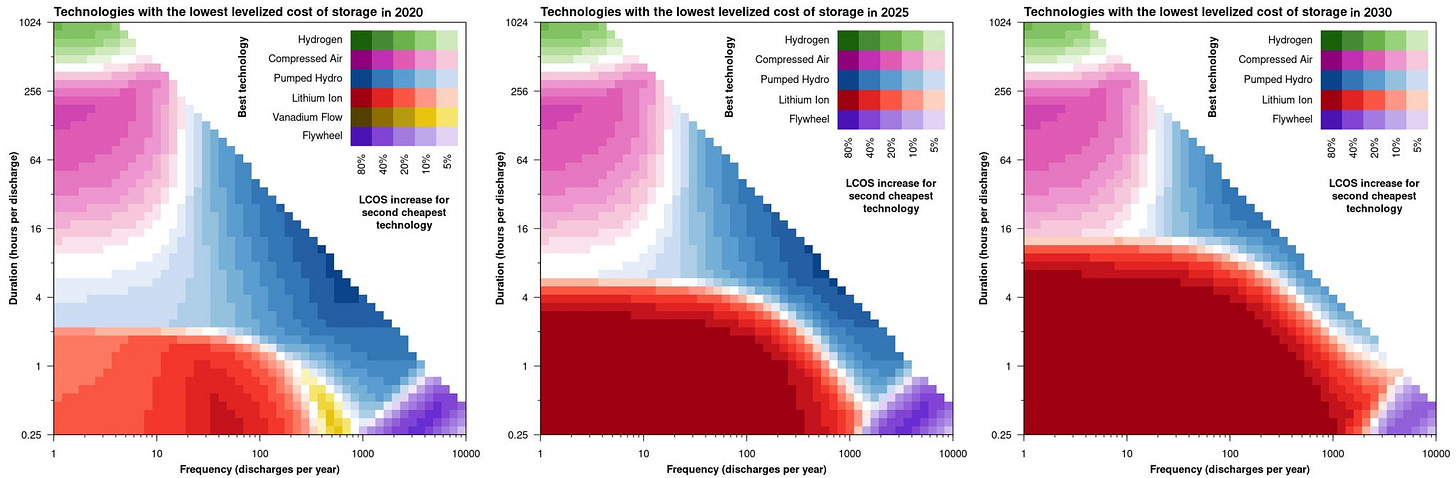

Some neat graphs on long duration energy storage by Oliver Schmidt, reflecting LIB and relative price comparisons year on year.

📰 What else we covered at Intercalation

Who’s Who Guide to Battery Modelling Software in 2026 part 1 and part 2 - two authors of this year’s Volta Foundation Battery Report give an accessible crash course intro to battery modelling software.

Charged Careers - an overview of all the places battery experience can take you.

The IBA Conference - Jess recaps research highlights from November.

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here

Thanks for all the work IS. Interested in any insight you have on the donut labs solid state batteries? Fake or a serious breakthrough?

Exciting times - progress of battery tech, renewable energy and everything else electric is simply amazing. Gives hope for a much better future!!