How Battery Projects Can Survive Tariff Turmoil?

What happens to your battery energy storage project when global trade tensions drive up costs by double digits?

Politics takes over from the technical here, and we called on our supply chain due diligence friends at Infyos and asset-backed financing experts at Tangible to take us through it.

Want to learn more? Infyos and Tangible are hosting a private webinar 12 pm BST on June 19th for battery energy storage developers to share practical examples of how BESS developers are mitigating tariff risk and addressing lenders’ heightened concerns. Register here!

For battery energy storage system (BESS) developers, the sweeping US tariffs have turned this question into a reality with projects already facing cancellation and importers bracing for triple digit tariffs on BESS containers.

Drawing on deep expertise across renewable energy supply chains and capital markets, this article unpacks:

How recent tariff shocks are disrupting BESS project economics

The practical strategies that leading BESS developers in the US, Europe, and globally are using to continue being able to fund their projects

How to maintain procurement continuity and manage investor confidence in an increasingly volatile trade environment.

US-China tariffs fluctuations create financial uncertainty for battery energy storage costs

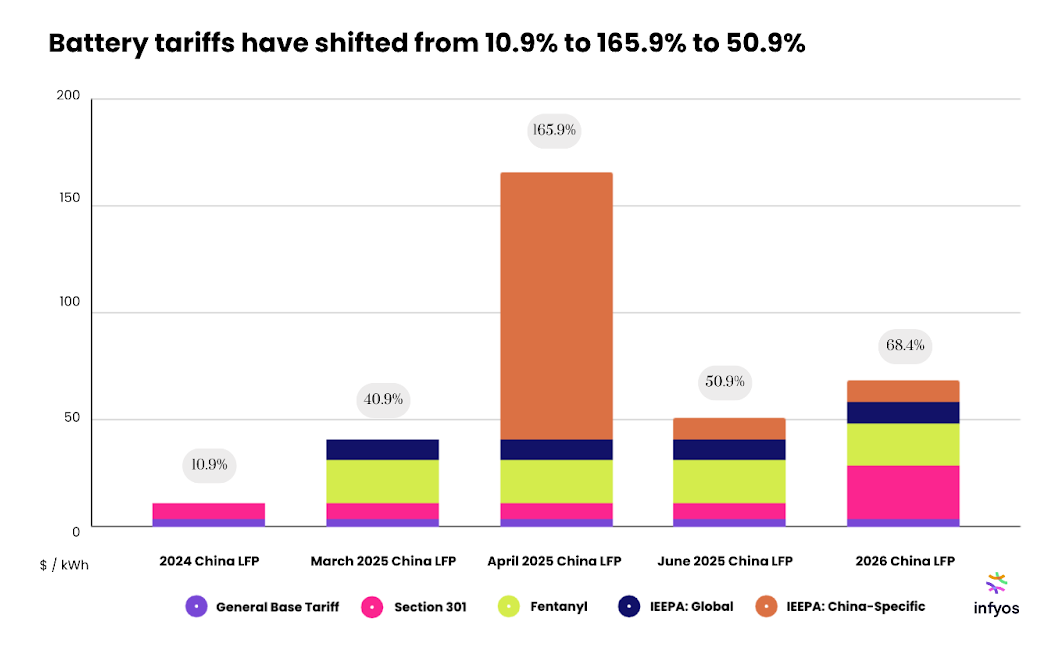

On 12 May 2025, Donald Trump announced a deal with China to clawback on tariffs. The last year of tariff fluctuations have pushed the tariff rate for Chinese lithium-iron-phosphate cells from the original 7.5% when Trump came into power up to 165.9% in April and back to 50.9% in the last month.

The future tariff figure is uncertain, but is expected to rise to 68% in January 2026 and potentially up to almost 1000% if anti-dumping legislation is approved in January 2026. These tariffs have major implications across the battery supply chain, especially because they are additive in nature.

The status of US-China tariffs on the wider BESS system

A BESS developer’s exposure, however, doesn’t just equate to the cell. A product can be subject to many different tariffs based on a range of factors, including its components. For instance, a BESS product could also be hit with Trump’s blanket tariff on global imports of steel and aluminum or be hit due to upstream battery components coming under fire:

Global Impact of US Tariffs

Although these tariffs apply directly to US imports, they have global implications.

1. Shift in Sourcing

US buyers are pivoting away from Chinese suppliers, increasing demand for alternatives from Korea and Japan.

2. Supply Constraints and Price Increases

Some European developers sourcing directly from Korea and Japan or with Chinese direct suppliers who have upstream suppliers from these regions may face supply constraints and rising prices due to this increased demand.

3. Price Pass-Through

Some Chinese suppliers are lowering prices in Europe to stimulate demand and counteract falling US sales. On the other side, there is a risk that Chinese manufacturers may raise prices globally to maintain margins, potentially passing the tariff cost burden onto both US and European buyers.

Why are BESS projects majorly exposed to tariffs?

BESS projects rely on long, complex and globally distributed supply chains. Batteries are, in essence, the culmination of numerous material supply chains, with minerals extracted across the globe, refined, turned into battery materials and assembled across several steps before reaching project sites.

Despite being global in scope, many of these steps are highly concentrated. For example:

Five countries - Australia, Chile, China, Zimbabwe, and Argentina - account for approximately 90% of global lithium mine production.

Three countries - China, Mozambique, and Madagascar - make up 90% of natural graphite supply, with China alone contributing 79%.

China holds over 80% of global manufacturing capacity for critical cell components

China accounts for 98% of global production for lithium-iron-phosphate (LFP) active material.

Nor are there signs that China’s dominance is fading despite calls to ‘onshore’ and ‘friendshore’ supply chains:

In 2024, 76 percent of global battery manufacturing investment remained in mainland China

A typical LFP factory in Europe or the US, for example, costs approximately $200 million more than its Chinese equivalent.

The way the supply chain works is global in scope, concentrated control and economically sticky. This makes it difficult for developers to pivot away from regions with high risk of tariffs under the current geopolitical situation.

How does the new tariff landscape impact access to finance for European BESS developers?

Beyond the impact on materials and direct costs, there is an additional complication for project developers in the U.K. and Europe. The tariffs add to market volatility that could potentially lead to higher pricing uncertainty in the near term. Investors are known to dislike economic uncertainty triggered by events such as trade wars, and may sell out of assets considered both risky, as well as safe, and retrench towards higher cash allocations to ride out the uncertainty.

This phenomenon holds especially true in the credit and corporate debt/asset financing markets where defaults cause a higher and more directly felt pain to lenders, which they are keen to avoid. Default risk is less acceptable in debt capital markets as compared to equity capital markets, where there is no implied obligation to return the capital, as investors get company shares for their cash. For BESS projects, which are capital-intensive from day one and rely substantially on access to long dated, economically priced credit, this sentiment translates directly into some degree of financing constraints especially in the near term.

For example, lenders typically price risk using assumptions around supply chain stability, cost curves, and projected cash flows, all of which become less predictable by lender models due to volatile trade policy. In particular, uncertainty around component pricing (e.g. cells, modules, inverters) and construction timelines can increase the perceived risk of cost overruns, or in more serious cases, a developer default. This can lead to higher interest rates, stricter lending covenants, or a reluctance to lend to anything beyond large established developers or projects. Innovators and newcomers in the space may get unfortunately overlooked despite having solid business plans and project backers/offtakers.

How can BESS developers respond?

Research by Kearney suggests that supply chain risks - including man-made disruptions (e.g. trade wars and tariffs), natural disruptions (e.g. storms), stretched logistics networks, and market imbalances - can erase more than €200 million of value per GW of capacity over a project’s lifetime. Tariffs, in particular, have emerged as a growing risk factor for clean energy developers, directly affecting input costs and procurement timelines.

However, developers can still address and mitigate the impact of tariffs and future geopolitical risks1 by developing the right operating systems that enable them to proactively identify, respond and build stakeholder confidence.

Immediate steps BESS developers can take

It’s vital that developers identify and report on tariff and geopolitical risk continuously, using a range of approaches and tools:

1. Supply Chain Mapping

Identify all key suppliers and their locations across the supply chain.

Assess exposure to regions vulnerable to trade restrictions, tariffs, or geopolitical tensions that could result in trade barriers.

Prioritise which components and suppliers (e.g. battery cells, inverters, raw materials) are most likely to be affected by import duties or re-export controls.

2. Risk Modeling

Overlay current tariff codes and anticipated trade measures (e.g. antidumping tariffs, Section 301) across key components and suppliers in the supply chain.

Track how specific countries are positioned in relation to current or upcoming trade restrictions.

Model the impact of different tariff scenarios and supplier choices on project costs and timelines.

3. Scenario Analysis

Develop multiple forward-looking scenarios based on key triggers like US or EU trade policy shifts, election outcomes, or WTO rulings.

Simulate impacts of potential tariff hikes or sourcing restrictions on procurement and margins.

Use these scenarios to stress-test procurement strategies and build contingency plans (e.g. alternate sourcing, reshoring, or stockpiling).

4. Improved Credit Messaging and Proactive Reporting

Finally, communicating risks and mitigation strategies clearly to investors and lenders from the outset in the credit due diligence process is essential.

For credit markets in particular, it is vital that you come with the right materials during times of uncertainty. Being prepared to address lenders’ heightened concerns by presenting an investment opportunity that balances economic upside with enhanced credit risk mitigation measures. This separates pragmatic developers from the crowd as counterparties that are in tune with prevailing market sentiment and worries.

Ultimately, this makes it easier for a lender to say yes and become a much needed partner in the company’s growth.

Broader procurement strategies for long-term resilience

No developer can entirely avoid exposure, but mitigation is possible. Some steps include:

Diversify suppliers and dual-source key components to reduce dependency on tariff-sensitive regions and build procurement contracts with tariff escalation clauses to mitigate cost fluctuations.

Strengthen agreements with OEMs, ensuring clear terms on tariff impacts, liability clauses, and supply continuity in case of disruptions.

Leverage data tools to monitor tariff changes, model their financial impact, and develop contingency plans (e.g. inventory buffers, reshoring) to ensure supply chain resilience.

Build buffers into project plans — for costs, timelines, and supplier requalification — to maintain flexibility under shifting conditions.

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here

🌐 Follow us on Twitter, LinkedIn, and our website

🌍 Geopolitical risk, political risk and tariff risk - what’s the difference?

Geopolitical risk is the potential impact of international relations – such as great power rivalries, conflicts or policy actions between countries – can have on a business. With a modern economy predicated on globalised and interconnected supply chains, the importance of geopolitical risk has grown significantly in recent years. As food prices soared in the wake of Russia’s invasion of Ukraine and tensions between China and the United States ratcheted up under Trump and Biden, businesses have become increasingly aware that actions between states can have a direct impact on business continuity.

Political risk focuses on impacts connected to a specific country (such as domestic regulatory changes, nationalisation or civil unrest), whereas geopolitical risk operates across borders.

Tariff risk and the enforcement of tariffs is a key example of how geopolitical risk materialises, as policy actions between nations disrupt supply chains and escalate costs for businesses across the globe.