Circling back

A few weeks ago, Lorenzo went through the challenges of second life systems, including cost and lack of data, and we also recently covered two recycling companies (Watercycle Technologies and Altilium).

There is a super interesting intersection and tension here between second life and materials needed for reycling recovery rates, and after listening to William Bergh, CEO of Cling Systems on Transmission, the Modo Energy Podcast, he was absolutely the right person to talk to about all of it. He kindly agreed to speak to Issy.

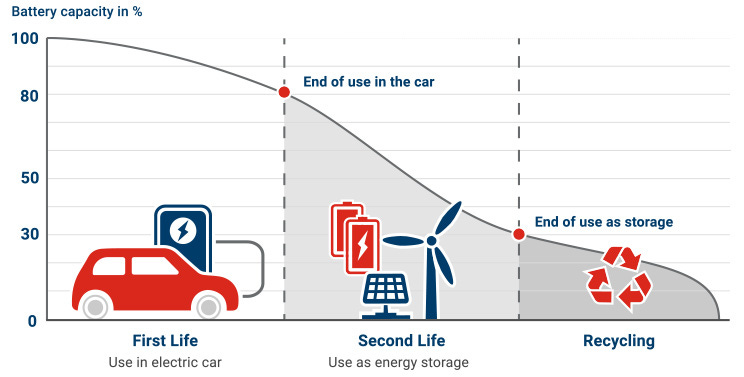

What if you never had to throw anything ‘away’? Nature does this extremely effectively, with nutrients such as nitrogen, carbon and water involved in cycles of different uses. In economics, this idea is called the ‘circular economy’ and for sectors like batteries where expensive minerals are involved, it makes particular sense to keep value in a loop getting used and reused.

At the end of a battery’s first life, when it has degraded to beyond giving useful value to its original use case, it might be used in an a use case where the energy density is not as important (eg. stationary storage). This is, provided the economics, regulations and end-customer demand allow. Making cells is energy intensive, and the more lifetime that can be squeezed out the better. Once cells are no longer good enough for these uses, they can be recycled and the minerals made into a new battery.

In this way, the battery industry can become a circular economy.

The EU has put in place a series of increasing requirements for recycled content in batteries, the first coming into force in 2031. Whilst these are providing a strong motivator for recycling start ups, often supported by OEMs, to get into gear, the lack of public investment similar to the IRA in the US has created financial challenges.

Without public funding, investors like VCs and OEMs have higher expectations for proving technology readiness as well as scale. Whilst this is a fair demand, it’s also a difficult one. The scale of material in Europe able to be consistently recycled is small. Not only have you got to prove high recycling efficiencies, there’s also the need to be financially viable, which doesn’t really happen at the small scales.

William described the problem to me:

I’m not really worried that batteries will be recycled, they will, it’s a lot of raw materials in there that are really precious. If it’s going to be in Europe, however, the governments must improve the financial and regulatory support, like those in China and the US, a lot. I don’t see it today, and I am worried that it’s too little and too late. Even if we are producing black mass, there is no commercially running recycling facility to extract battery grade raw materials at scale.

The first major regulatory milestone is 2031, when batteries sold in Europe will be expected to meet minimum recycled content of 6% lithium, 6% nickel and 16% cobalt.

I asked William about the comments he made on the Transmission podcast, which suggested that OEMs were stockpiling spent batteries to recycle for compliant 2031 batteries. Might we see a ‘valley of death’ where people avoid recycling in the late 2020s?

I’ve heard that some OEMs and producers may be considering stockpiling batteries now to meet future compliance standards. Maybe they do it since raw material prices are low at the moment and export is increasingly not ok. Regardless, this approach might lead to a temporary slowdown in recycling. It’s a classic case where well-intentioned regulations have unintended consequences. I believe the best way towards more recycling is less market friction.

Also, I spoke with a market researcher recently and we discussed whether the new regulations are there for sustainability, or energy security or job reasons. We concluded that they clearly support the latter two, but not the first. One of the best characteristics with circularity is that prices directly correlate with sustainability - the higher recycling rates the higher prices. So, sending raw materials to the highest bidder is typically the most sustainable option.

There are another set of regulations 2036 too, are companies really worried about their compliance for this?

Companies are steadily gearing up for 2036 compliance, and it seems OEMs are particularly focused on end-of-life collection to secure better terms with suppliers. By entering end-of-life collection, stockpiling waste materials and using tolling arrangements, OEMs seem to aim to control the raw material supply, ensuring that their suppliers have feedstock of recycled materials for producing compliant cells.

The 16% of Cobalt, it’s quite high and it’s based on assumptions of how long batteries last that was done in 2019/18 when these numbers were first drawn up. Everyone has realised these batteries last longer, so maybe there’s not 16% Cobalt available at all in the entire market.

Are these regulations aiming to make Europe a more sustainable place working?

I believe the focus shouldn’t be on whether batteries are recycled somewhere eventually - they will - it’s more about ensuring European recycling remains competitive. Otherwise it will not happen. While export barriers are being put into place to keep material in Europe, China and Korea and many others around the world are investing heavily in recycling because they see the economic and environmental value. Europe isn’t the only player concerned with sustainability; these markets are equally committed to climate change and efficient recycling practices. Recycling will become a reliable source of raw materials, and all regions will want to tap into that. If Europe wants to keep raw materials, we should not ban exports, we should subsidize recycling.

CATL in fact boasts a lithium recovery rate of 91.0%, and a nickel-cobalt-manganese recovery rate of 99.6%. They are also recycling LFP on an industrial scale aiming for 1 million tons. Robin Zheng, CATL’s CEO, states that ‘by 2042, we expect that half of the batteries produced globally will be made from recycled lithium and half from mining new minerals to meet society's demands.’

How about second life batteries, are they currently a feasible option?

The idea of second-life batteries is appealing. I really hope it works, yet the market is young and it’s too early to tell. Repurposing batteries requires costly, ad-hoc engineering and specialized labor, making it difficult to compete with the efficiency of new systems, especially LFP systems from China.

Is there a second life industry in Europe at the moment? If not, why, what are the challenges?

There’s definite progress, with companies like Evyon, Voltfang, BeePlanet and Zenobe pushing to industrialize second-life batteries for commercial, industrial, and grid-scale applications.

However, scaling this market remains challenging. Every used battery must be tested to ensure compatibility with each other - a process that’s expensive, time-consuming, and available only at a handful of sites. Since each used battery is unique, manufacturers must recertify every new system design individually, a process that can take months. Logistics compounds the challenge, especially when every battery transport requires UN38.3 documentation, which so far are available only on request from OEMs. Furthermore, second-life batteries are often repurposed from NMC automotive cells, which typically offer around 1,500 cycles and significantly fewer than the roughly 10,000 cycles expected for stationary systems. While the potential is there, the second-life battery industry in Europe remains in its early stages and is likely to stay a niche market for the time being. This is my view today and it has changed many times and will probably change many times again.

So is there any hope for a second life battery industry?

There is promising potential in markets like South East Asia, India and Africa. In these regions, lower labor costs and more flexible certification processes allow repurposed batteries to meet practical energy needs.

So where does Cling Systems fit in to all of this?

Circularity—whether it's reuse, repurposing, or recycling—relies on matching supply and demand in every detail: product specs, pricing, volumes, logistics, regulations, tariffs, and timing. When any of these elements don’t line up, friction appears. That’s where we come in. Our brand new platform S1 and our years of hands-on expertise cuts through all that friction, making it easier for buyers and sellers to directly connect and complete transactions. By digitizing how idle batteries are bought and sold, Cling creates an ecosystem with much higher profits and much lower risks, which ultimately accelerates battery circularity.

The reality of a circular economy and waste stream supply chains gets closer each day, but sometimes it does feel like the recycling industry in Europe, without a helping hand from subsidy, is facing The US Office’s Michael Scott dilemma in the need to be profitable.

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here