Berlin’s Future Battery Forum

Our newest team member Román recently had the chance to attend the 6th Future Battery Forum in Berlin. It was a 2-day event filled with panel discussions, presentations, workshops and deep dives into the different sectors of the battery ecosystem.

The European battery sector has struggled to meet the expectations it set itself, even though a diverse portfolio of companies is present in the continent. Northvolt’s bankruptcy significantly damaged the sector’s hope, but it is not over. In the 6th Battery Forum, challenges, opportunities and strengths were discussed along with tech innovations. Five key themes stood out to me, so here are my takeaways…

1. Europe’s bottlenecks

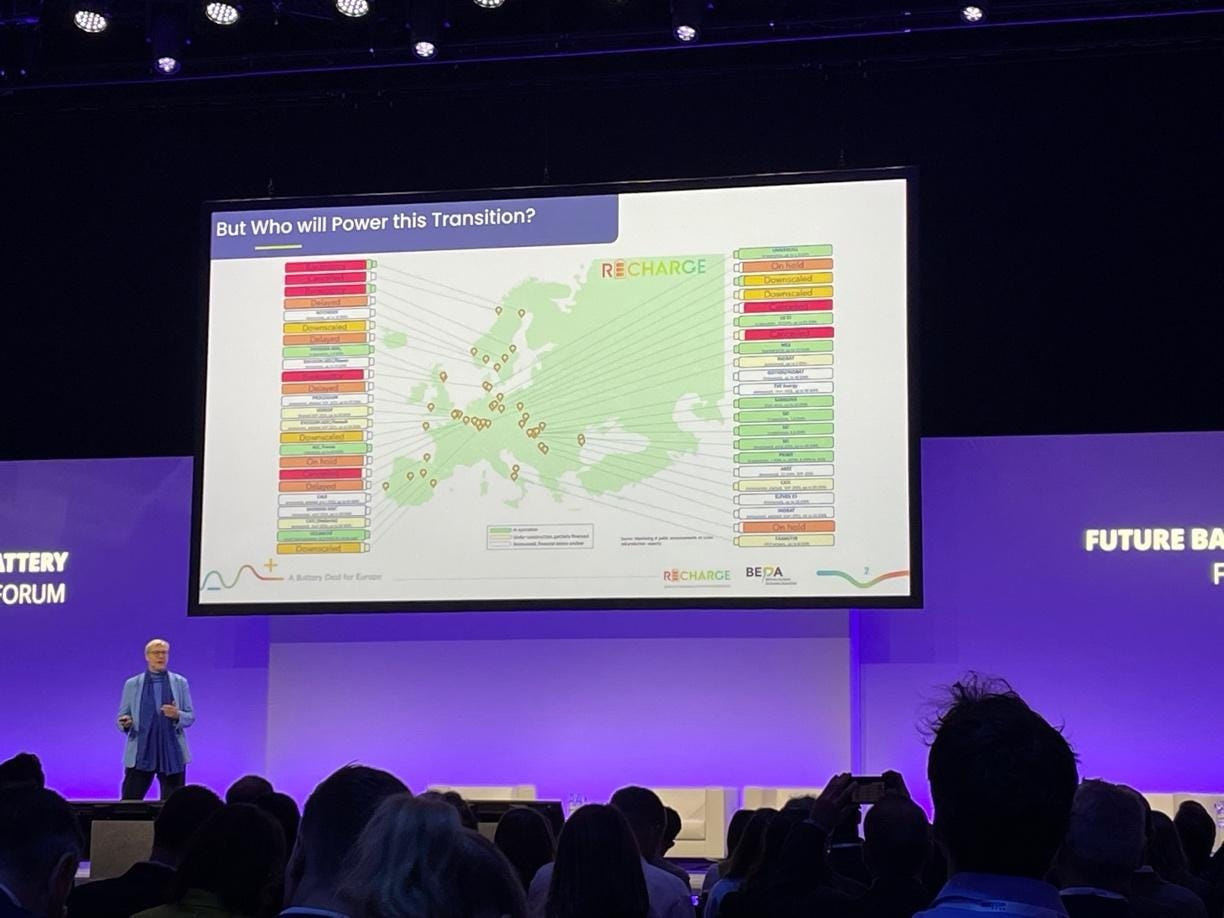

Recently Verkor, ACC and PowerCo raised the question of who was going to make the batteries of the future. And so did Ilka von Dalwigk from Recharge, an EU industry association promoting battery development and circular economy, she pointed out that many projects were put on hold, went bankrupt or simply cancelled.

Ilka stressed that to have growth in the sector we should focus on the 4S’s. Firstly, Scope, which briefly refers to having tailored focus across the whole value chain. The second S is Scale, where she really emphasized that it is at this point that Europe is behind and we need more tools, in particular funding & partnerships, to reach industrialization stages. The third one is Speed, which is referring to one of the most talked about topics in this conference, bureaucracy. Having the EU bloc, then national-level differences coupled with a lack of regulatory clarity, results in slowed down project construction. The fourth and last S is Sustainability, which not only refers to environmental but also economical sustainability. The latter is essential to keep projects running.

Scale and Speed were the most repeated arguments as to why the European battery ecosystem was not growing, and many speakers agreed with lack of sufficient funds and vast regulations being central to stopping the growth. However Matt Shen from CATL, pointed out a talent shortage, which makes foreign companies relying on imported talent, as they are planning to do with the factory in Zaragoza. High scrap rates in early production phases also make scaling up very costly. Dr. Daniel Schönfelderfrom BASF, Matthias Sckuhr from Freudenberg ST and Jon Fold von Bülow from Morrow Batteries highlighted the need for partnerships to unite the whole European value chain. Europe’s energy demand is surging but it is struggling to keep up with it due to geopolitical pressures and industrialization slowdown.

2. New industrial strategies

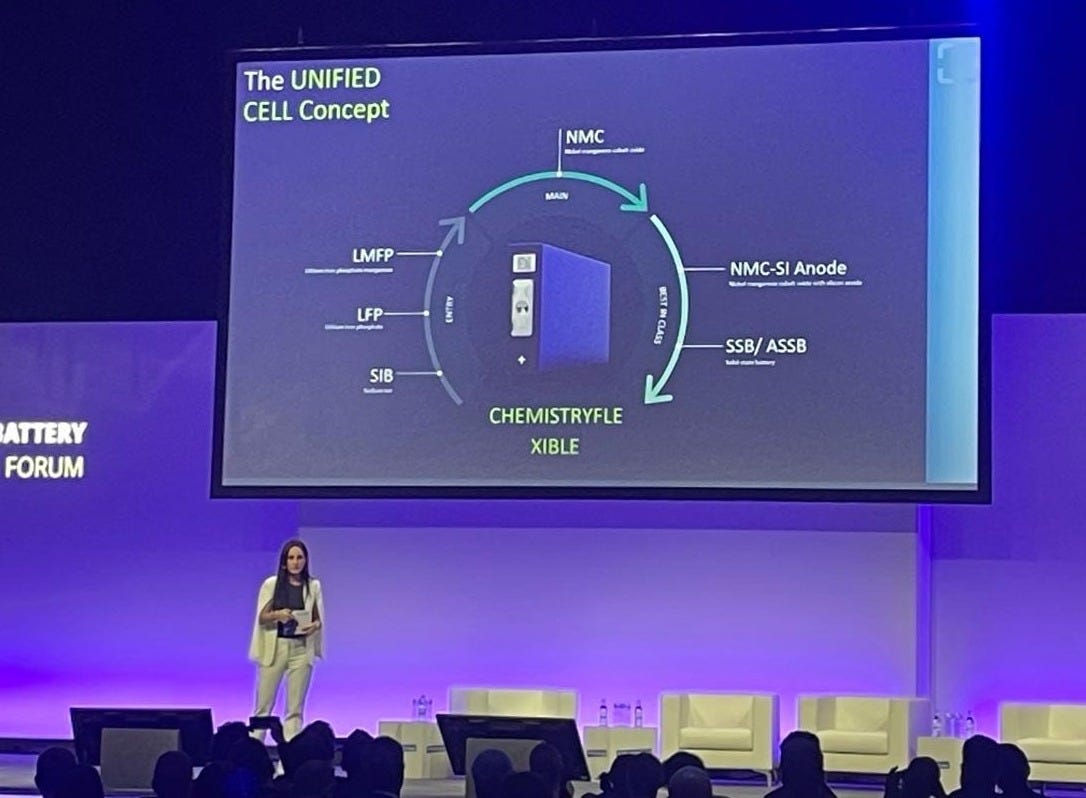

Standardisation was proposed by PowerCo as an alternative to quickly scale up while still keeping performance. Their Unified Cell Format (UCF), which is a prismatic cell, demonstrated 660 Wh/L and is chemistry agnostic. Currently, they tackle NMC, but aim to expand to LFP and LMFP; as well as Na-ion.

Diversification of battery chemistries was also mentioned by BASF as a way to reduce reliance on critical minerals and scale faster, if companies can excel in the chemistry(ies) chosen. And again, to reach excellence, partnerships are key. For instance, BASF is a leading supplier of cathode active materials (CAM) and they recently announced a partnership with CATL.

Modular platforms, instead of pack based platforms, are another way to speed up industrialization as shown by Mercedes or Microvast. Both companies have an eventual aim of vertical integration. More notably, Dr. Uwe Keller from Mercedes stated that more than 90% of batteries in future cars will have a common battery platform, making cell size and cell chemistry the main factors to define car range.

3. Tech innovations that give hope

Morrow Batteries was one of the most realistic companies about the difficulty of reaching excellence in manufacturing at scale. Their high voltage LNMO hopes to solve “performance, cost and supply chain issues”. It is a high voltage spinel that when paired with graphite has a cell average voltage around 4.5 V, and it is safer than NMC due to the lower Ni content and manganese offers structural benefits and lower costs. However, due to the high voltages, current electrolytes suffer from stability issues, making this one of the main bottlenecks. Their idea is to pair such technology with niobate anodes, which would allow for high power.

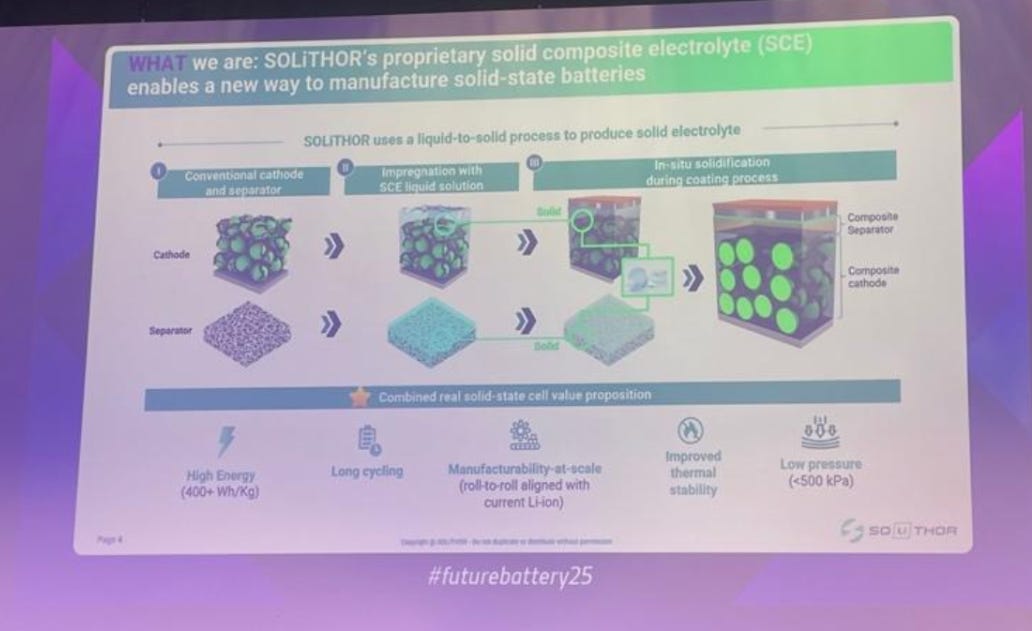

On the frontier of solid-state batteries, Factorial Energy’s CEO Siyu Huang and Cedric Nouillant from Stellantis, presented more details on their partnership and they stated that the jointly developed technology that showed 375 Wh/kg will be incorporated into demonstration fleets by 2026. In the start-up ecosystem, CEO Rodrigo P. Navarro, introduced his company SOLiTHOR, a spin-off from imec in Belgium. Their technology is based on a sol-gel synthesis of solid electrolytes, making it more scalable and cheaper. Currently, they are manufacturing multilayer 1-5 Ah solid-state pouch cells.

One company that caught my attention is LIMATICA, a startup developing an integrated diagnostic system designed to address the challenges associated with battery formation cycles. Their Managing Director, Bastian Ruther, introduced their idea that claims to reduce the formation cycle step from days to 30 minutes. To do so, they apply small voltage-noise steps, which are small perturbations that expose electrochemical patterns and, together with their patented algorithms, enable prediction of self-discharge. Now, they have already proved their concept with battery manufacturer EAS.

4. The role of AI and automation

AI and automation of processes are a hot topic right now everywhere. One of the interesting points that was mentioned in the first panels was that due to the higher labour cost in Europe, the need for automation where possible is important.

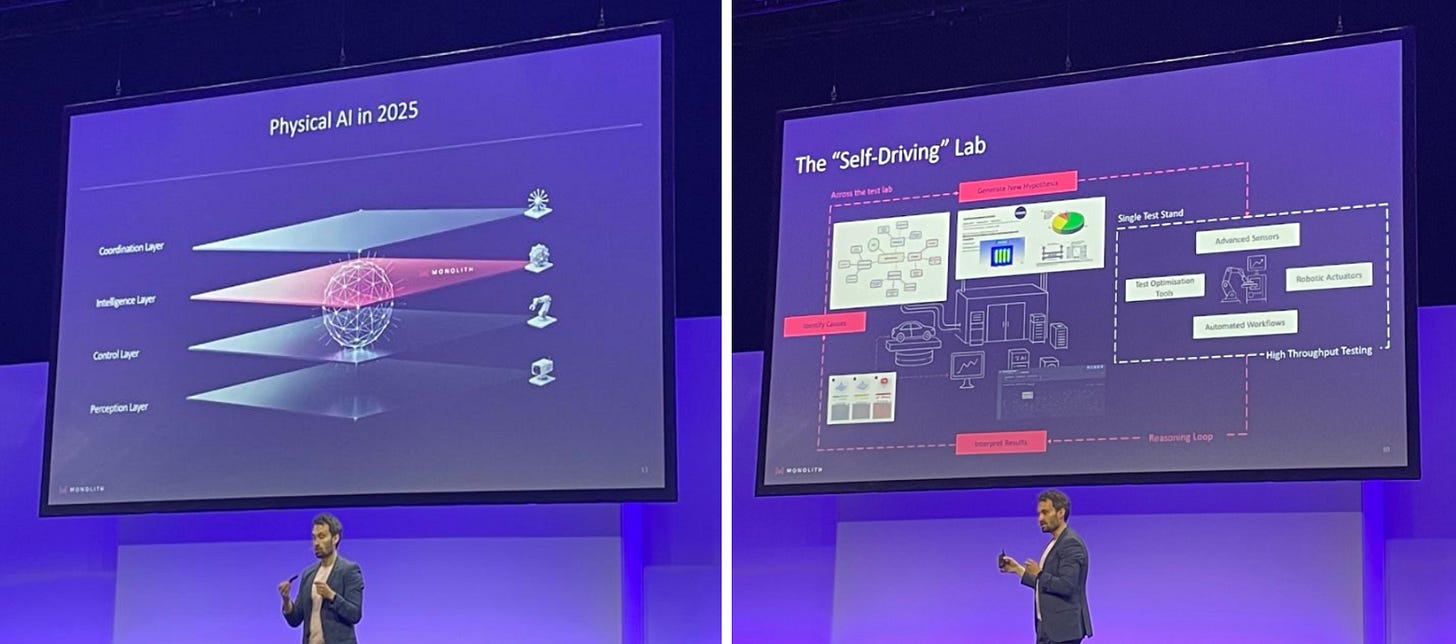

I was able to listen to a talk from Dr. Richard Ahlfeld, CEO at Monolith AI. He presented the “Self-driving lab”, which is composed of an AI that runs predictions based on real test data from cells, and it can learn how to predict outcomes and detect anomalies. More notably, it can also use its learning to suggest new pathways to shorten testing. He touched on gathering data from companies, which as of now remains a bottleneck due to IP. Currently, companies share their domain expertise but not data, and it’s likely that companies will have to collect or buy their own data sources.

Right after Monolith AI, it was the turn of Siddharth Khullar, CEO of Aris Machina, a start-up that raised almost $11M in pre-seed. Siddharth co-founded the company with Peter Carlsson, ex-CEO of Northvolt. They bought 9 petabytes of real industrial data from Northvolt, which is the equivalent size to downloading over 2 million copies of Shrek the movie, and they are on the mission of building an industrial superintelligence. They say that they recognised the mistakes that were made when scaling up Northvolt and wanted to help others solve similar issues.

During his session, he introduced two new products: Gemba and Protos. Gemba aims to act as a shopfloor agent to drive uptime, yield and manufacturability. Protos is a tool that will act as a co-engineer to accelerate battery design and reduce costs. Ultimately, the idea is to use AI to spot and correct errors on the production line as well as in R&D .

It is worth noting that AI was mentioned in most of the talks, as most companies are integrating it to optimise processes. Dr. Stefan Kreiling from Henkel delved into their development of digital twins for adhesives. Dr. Wenjuan Matthis from Microvast highlighted their AI tool used to analyse lifetime parameters with errors decreased to 1%. Factorial Energy emphasized that the advances done would have not been possible without their AI digital twin Gammatron, which enables them to optimise cycling protocols and predict lifetime indicators.

Lastly, I also had the chance to catch up with Ian Campbell, co-founder of Breathe Battery Technologies. He shared more insights into their work on adaptive charging software, which dynamically controls charging protocols in real time. He also mentioned their upcoming release of two new software tools designed to help engineers simulate and optimise cell behaviour.

5. Recycling as a promising option to close the loop

The final main topic of this conference was to try and find ways to set-up a European value chain that is connected from the mines where minerals are extracted to the customer. As Dr. Anna Moisala from Talga Group and Christian Freitag from Vulcan Energy stressed, Europe has significant mineral resources but we lack the refining capabilities. Therefore, adding another step after the customer is key to closing the loop, hence reducing reliance on imports. That last step is recycling, where e-waste is recovered and processed into usable starting materials.

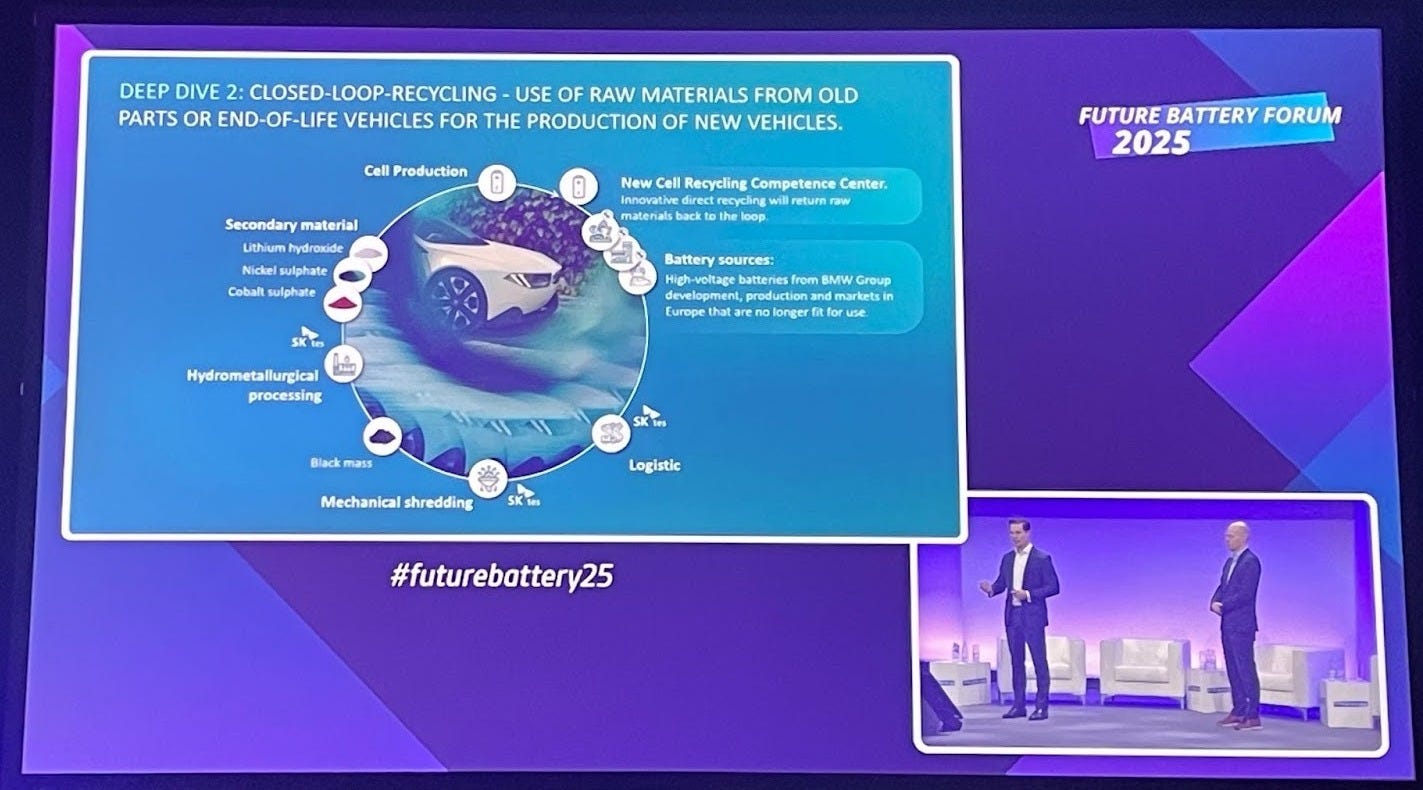

Jörg Lederbauer from BMW and Manfred Schmidt from SKtes presented the ongoing BMW-SKtes partnership that finds ways to close the loop. BMW presented their two projects: reusing old parts for second life application, and recovering raw materials from end-of-life vehicles. As of now, BMW is dismantling up to 10,000 vehicles per year.

The partnership between the two companies centres on recovering raw materials. After BMW dismantles the vehicles, SKtes takes over and leads the recycling process. The batteries are first dismantled in Herten, then shredded into black mass in Rotterdam. The resulting material is shipped to Korea for hydrometallurgical refining, before being returned to BMW. This collaboration demonstrates that a closed-loop system is possible and highlights the importance of strong partnerships. However, one concern raised by the audience was the absence of a hydrometallurgical facility in Europe. This raised doubts about how the returning recycled materials would be classified when re-entering the EU: would they be considered foreign or European?

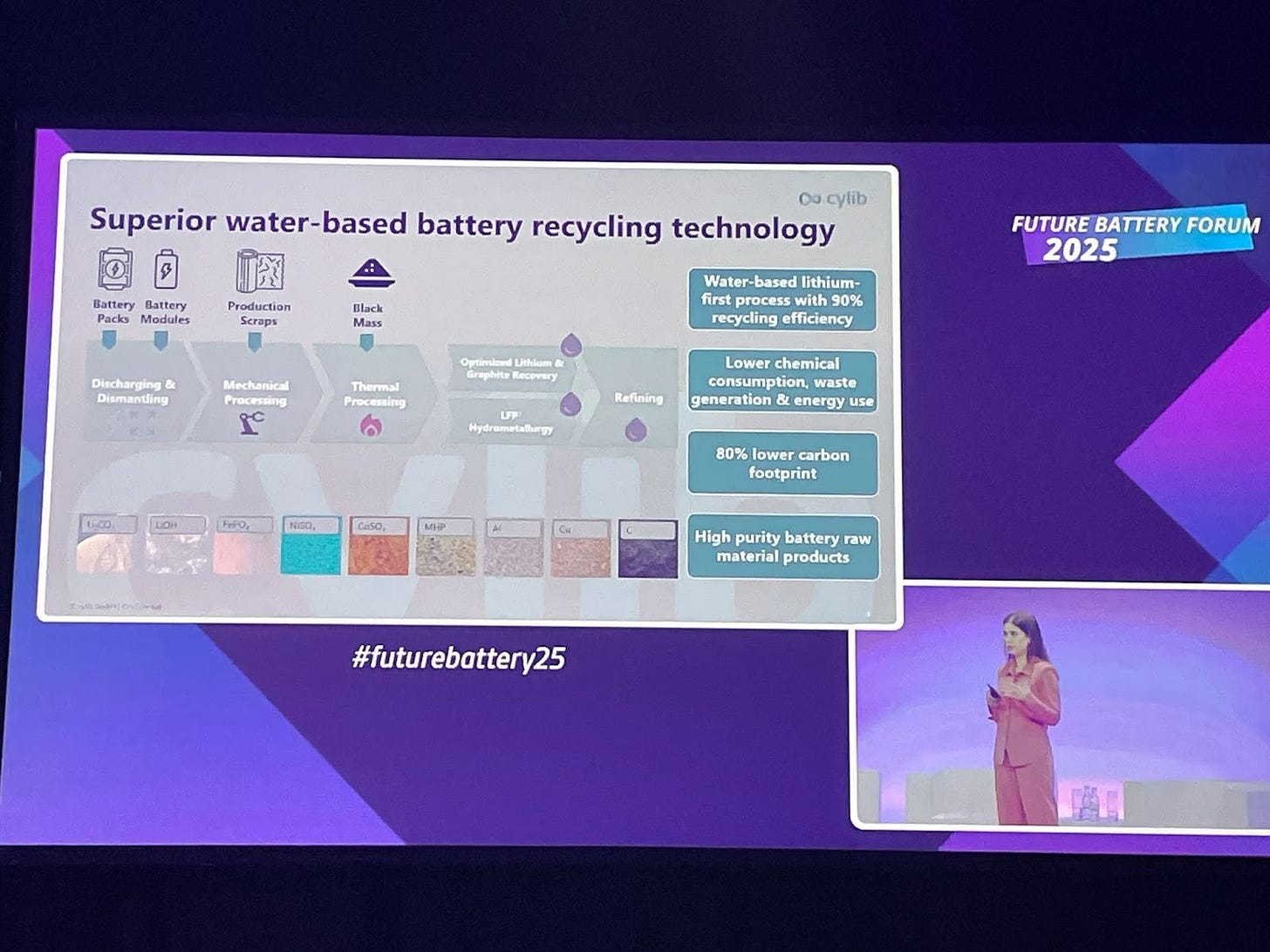

This question did not trouble the next speaker, Dr. Lilian Schwich CEO at cylib. Her and co-CEO Gideon Schwich are on the mission of changing the way we recycle batteries. Their technology is water-based and recycles black mass into raw materials with a 90% efficiency for lithium and graphite. As of now, they have 37 customer projects with OEMs, Tier 1 suppliers and battery manufacturers. More notably, the future plans involve a plant in ChemPark Dormagen (Germany) that will be agnostic to battery types, geometries and chemistries, with a recycling feedstock of 140,000 per annuum.

Final thoughts

The 6th Future Battery Forum was an insightful event filled with discussions on how to push forward to the European battery industry. Having panel discussions gave way to many ideas and to understand what are the needs for industry to succeed. Momentum is building for a more competitive and resilient European ecosystem: Recharge proposed a Battery Deal for Europe, and the soon-to-be released Industrial Accelerator Act will be gratefully welcome.

If I had to summarize the event with one sentence, I’d use Jon Fold von Bülow’s phrase: “Pramagatism, proof and partnership”.

🌞 Thanks for reading!

📧 For tips, feedback, or inquiries - reach out

📣 For newsletter sponsorships - click here